The purpose of this article is to show how to write off bad debts when you need to. If the debt is over 90 days and you know you will never receive the payment, it can be classified as “bad debt” and you can write it off as a company expense.

NOTE: There is video with great information available on how to write off bad debts. http://www.youtube.com/watch?v=EpRAnQ73Bxo

Essentially what you need to do is to:

- Remove the debt amount from the client’s trade debtor’s account over to an expense write off account in the profit and loss

- Make the necessary adjustments to claim back the GST that was submitted to the tax office

This is a 4 step process which includes which includes Checking if Bad Debt GL Account is Available on Your System, Moving the Balance From the Client’s Account Over into the Bad Debts Expense Account, Creating a Debtor Receipt and Finally Check on Your Debtors Account Balance & set them to CASH or give them a credit limit to prevent it happening again.

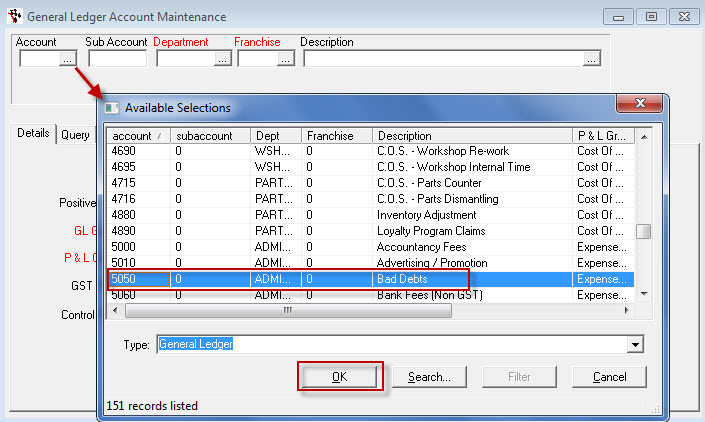

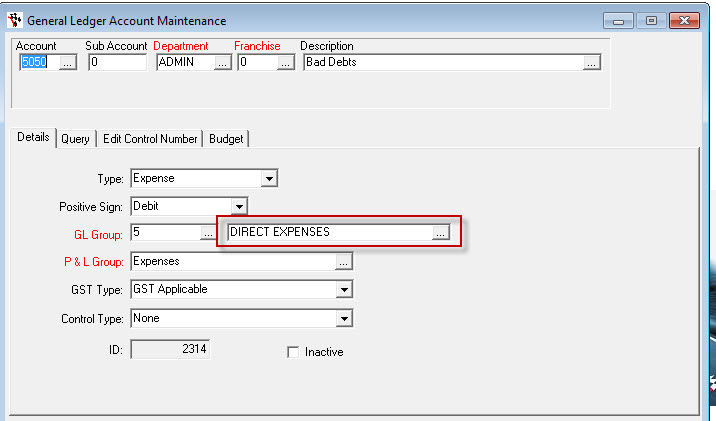

1. Check/Create af Bad Debt GL Account

- Go to General Ledger- General Ledger Accounts

- Search for Account 5050 – Bad Debts

- This is set up in the direct expenses parts of the profit and loss in the chart of accounts. If this GL Account doesn't exist in your system, create it.

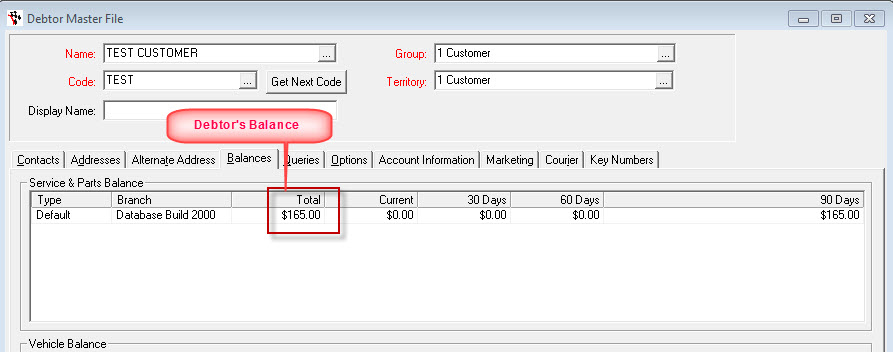

2. Move the Balance From the Client’s Account Over into the Bad Debts Expense Account

Example: My client never paid $165 they owe and I wish to write it off.

Client's debt record

To Write it Off:

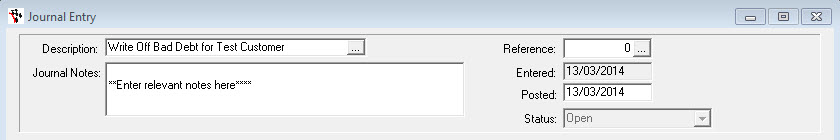

- Go to General Ledger - Journal Entry

- Open General Journal Voucher

- Fill up the following information on the header area:

- Description -give it an appropriate name eg. “Write Off Bad Debt for Test Customer"

- Journal Notes - Add relevant additional notes according to your preference

- Reference - Pick Client's previous invoice reference number (This populates the grid below)

- Posted Date - Select posted date

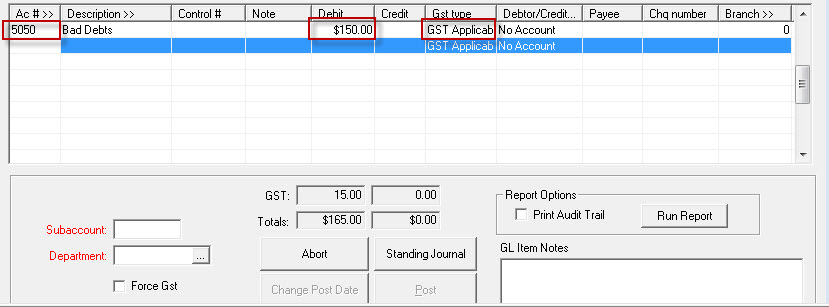

GL Line 1

- AC# Column - Select Bad Debts Expense Account (5050)

- Debit Column - Key in the amount that you want to write off to the bad debts

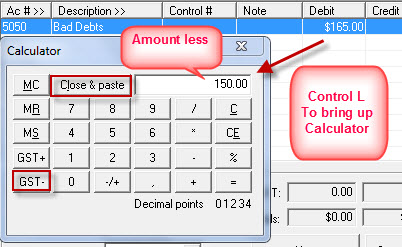

Note: just enter the net amount and claim the GST back to do this. To do this:

- Bring up calculator (control L)

- Enter the amount and click GST-

- Close and paste

- Tab through

- Set GST Type to GST Applicable This is to add the GST to the debit amount to bring up the grand total of debtor's debt. As per our example, debtor's debt has a grand total of $165.00

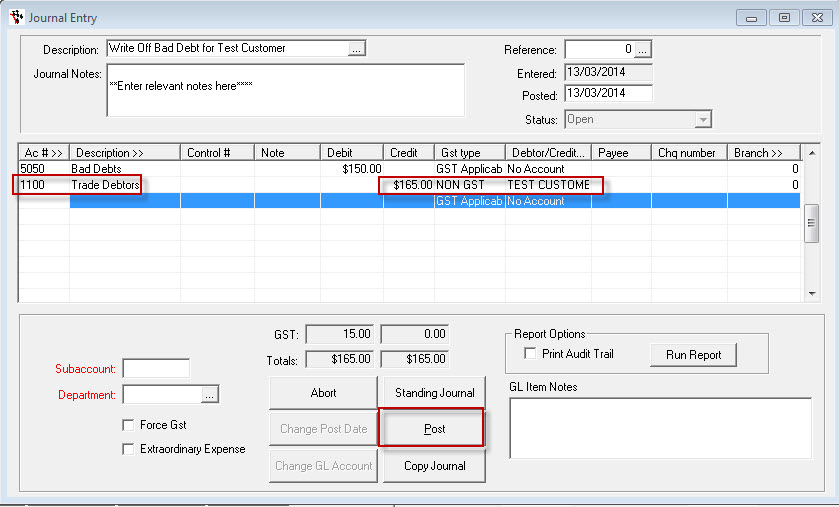

GL Line 2

- Bring up the Trade Debtors control account – GL 1100

- Credit the full amount (with GST) against the trade debtors control account

- Set GST Type to None

- Account- Select debtor’s account

- Post the Journal

This will adjust the balance of the debtor by adding the journal amount to client’s account

3. Create a Debtor Receipt

This is to balance journal the amount to its appropriate invoice

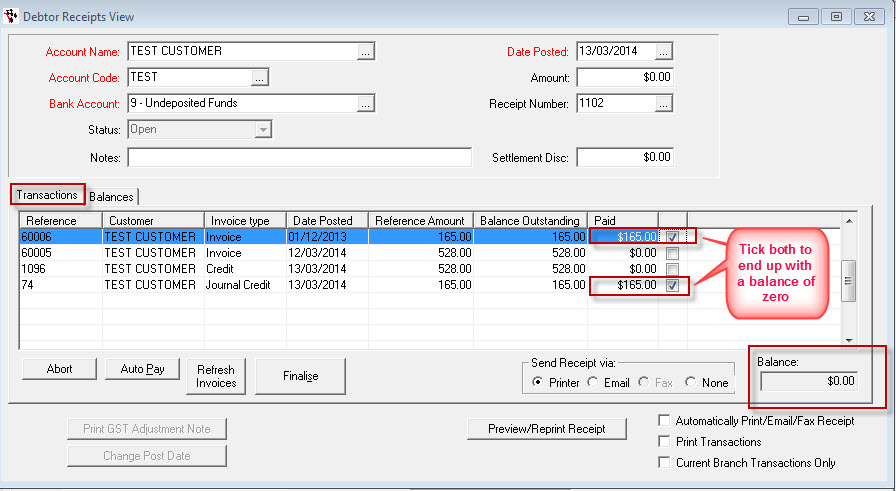

- Go to Accounts - Debtor - Receipts

- Go to Transactions Tab

- Fill in all header information

- Set Amount and Settlement Discount to Zero

- Tab through (this will populate the lower grid with the invoice and journal entry you have made)

- Tick off your Credit and Invoice to give yourself a balance of zero

Note: This is done to match the journal to the invoice to show that the journal relates to the invoice

- Click Finalize

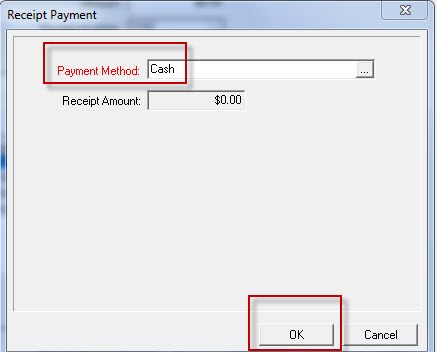

- Set receipt payment to cash since there’s no money moving

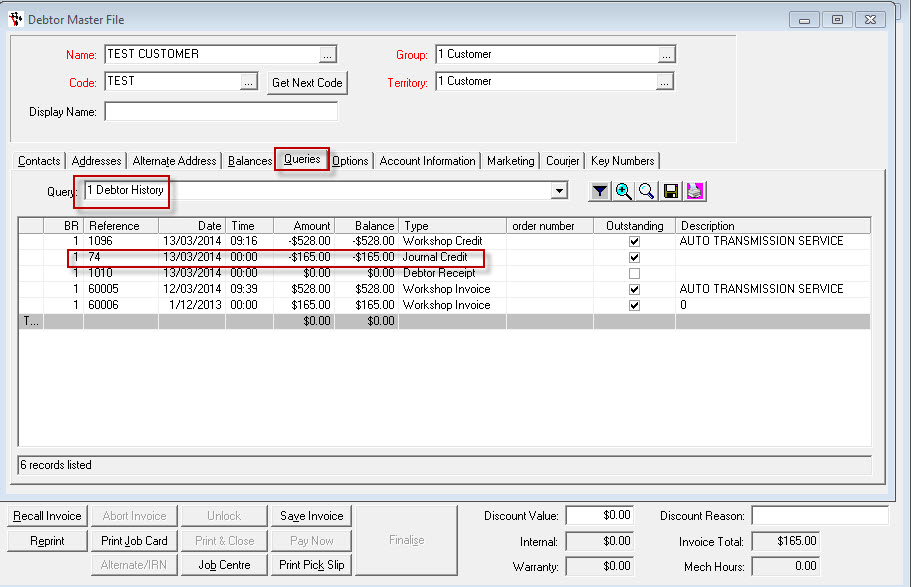

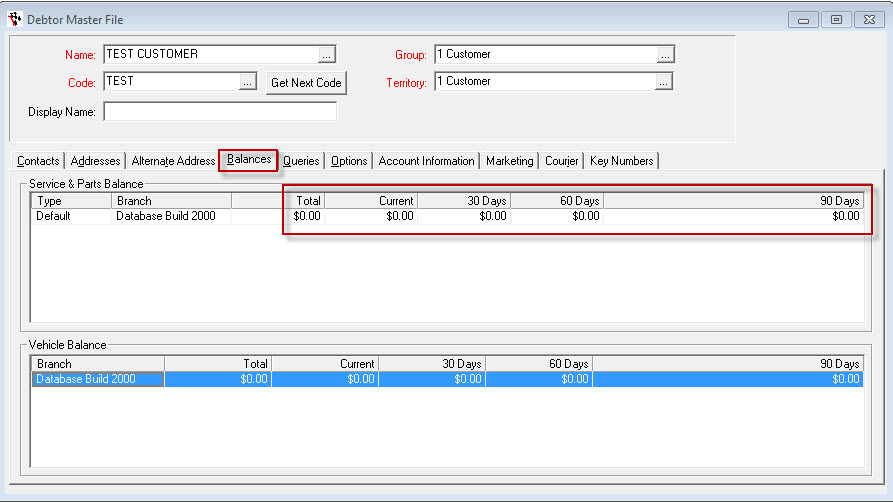

4. Final Check of Your Debtor Master File

- Go to Accounts - Debtor - Debtor Master File

- Open client's record

- Check the Balances tab- client now has no balance owing

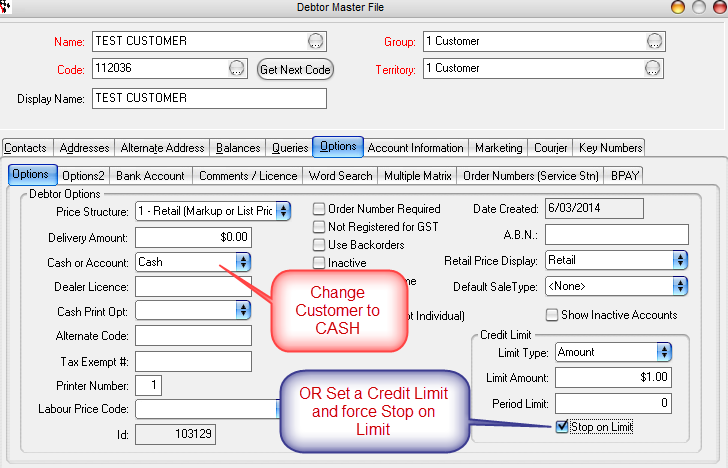

- Go to Options tab and review client’s trade terms

- Change account to "Cash" terms to make sure he can’t get anything on trade credit again

2 Comments