The purpose of this guide is to explain how and why you should keep track of negative stock and Cost Adjustments to you Parts GLs.

When a Part is sold and you have not entered the creditor invoice into the system yet, this will cause the Part to go into Negative. The Profit is calculated at the time of the sale, therefore if the Cost changes when you eventually do enter in the Creditor Invoice, this could cause the actual profit of that period to be incorrect. Therefore good housekeeping processed to stick to to prevent this is;

1. As soon as Parts Come in, Enter the Creditor Invoice to update the Part Stock Qty, Cost and applicable mapped GLs

2. Only once the creditor Invoice has been received in Invoice the Part out to your Customer.

If your Stock has gone into Negative, Here is how you Report on All Negative Stock

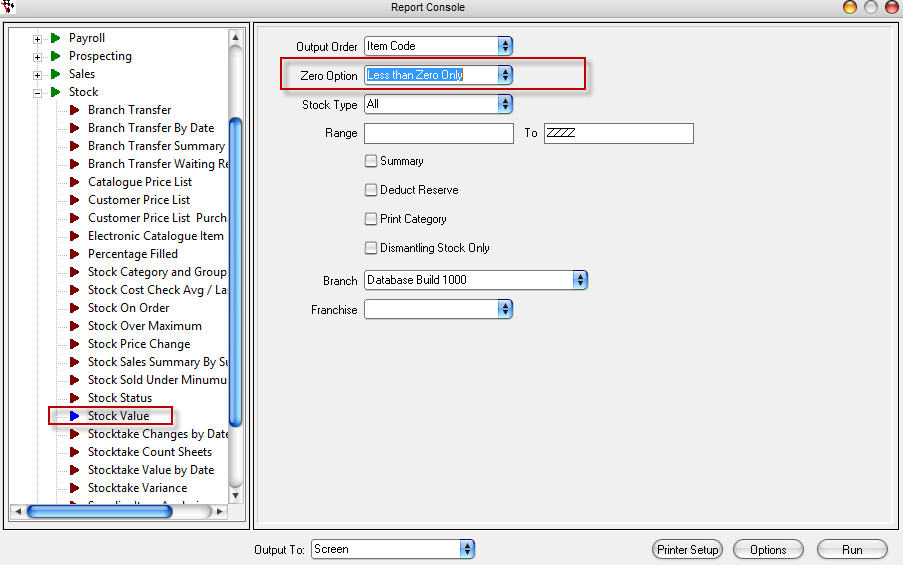

- Go to Reports Console - Stock - Stock Value

- Select Zero Option Less than Zero Only

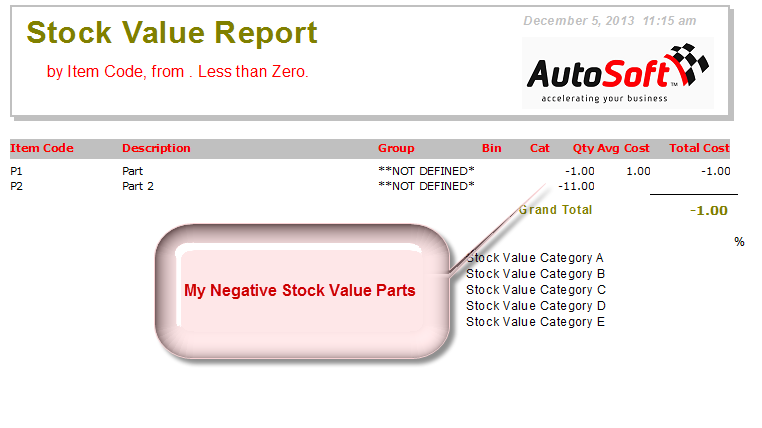

- This will then show all the Parts of which you have Negative Stock.

You then need to find out why - if you find a Creditor Invoice for the Parts that was not entered yet, entering it will resolve the issue. If you can not find a Creditor Invoice, you will have to adjust the stock manually.

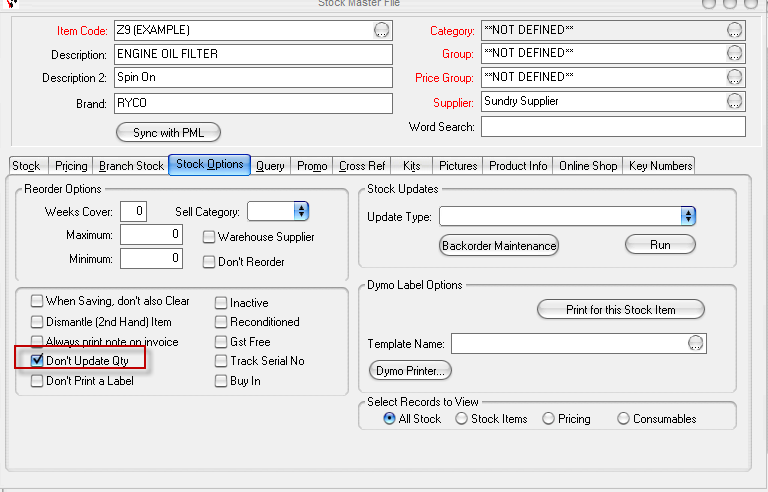

If you do not want to keep track of the Stock Value and Cost of a Part, after you have stocktaked it;

- Go to Stock Master File - Search and Select the Part

- Stock Options Tab - Tick option 'Don't Update Qty'

If you are having trouble with what has already gone into negative and have negative cost adjustments in your GL - See the attached Generic Parts guide on how to investigate and fix these.

2 Comments