The ATO have put in place a requirement for all Payroll systems to allow for the exporting of superannuation data. This data is to be exported into a csv format file that you can then upload to your Clearing House. The Clearing House will then process this file and send on the Superannuation information.

Superstream is available in Update 5.98.16.0601

To be able to give you the most information that we can, we have had to make some changes t the way that the superannuation works in the software:

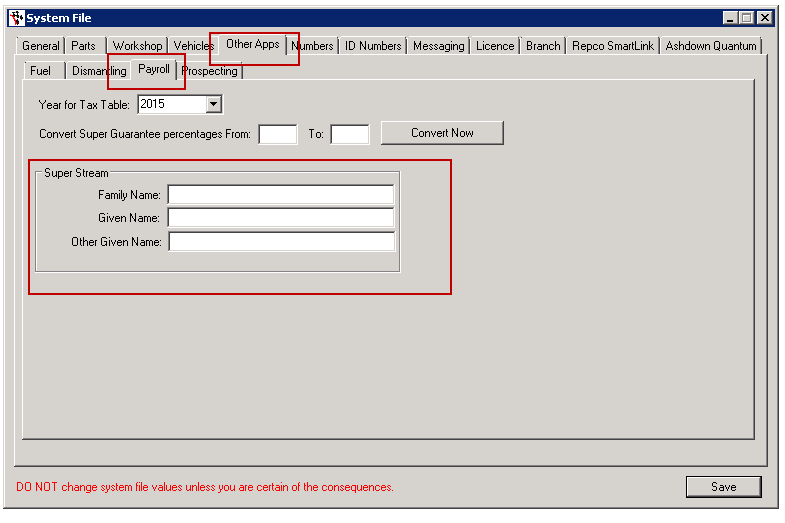

1) Your Company will require the name of the Owner of the company. This is entered into in the Setup - System File - Other Apps - Payroll

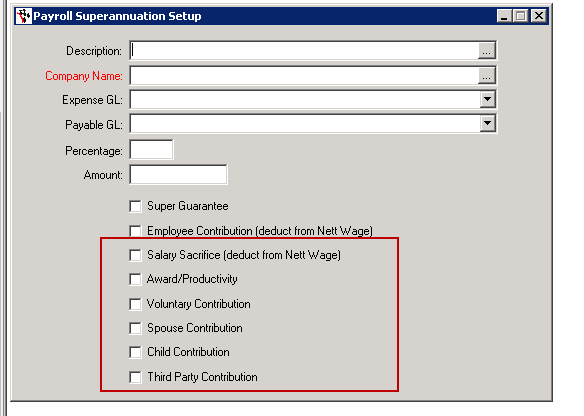

2) All Superannuation amounts must now be separated so that they come up in the correct column on the spreadsheet. To do this, you need to use the tick boxes provided. As an example, if you are have a Super company, Sunsuper, in the past you only needed one Superannuation type for this company. Now, you need, minimum 1, or 1 for each of the boxes ticked (8).

The new types are:

- Salary Sacrifice

- Award/Productivity

- Voluntary Contribution

- Spouse Contribution

- Child Contribution

- Third Party Contribution

Employee Contribution and Super Guarantee remain as per normal.

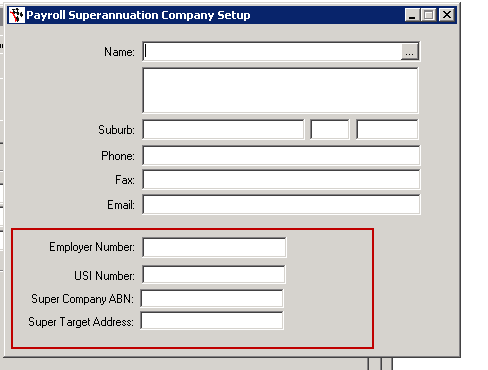

3) All Super companies will require a USI Number, A target address for their online Superannuation data transfer (usually a website address) and the Super Company's ABN. If you also have an identification number with the Super company, enter this in the Employer Number box These are to be entered in the Super company details setup screen (see screenshot)

New Process

1) Go to Payroll - Superstream File Creation.

- If you cannot access this due to an ACCESS DENIED, go to User Security Settings below before you proceed.

2) Select a folder to save the file

3) Select the range of dates for this to run. This goes off the payroll post dates

4) Press Export

A message will come up advising that this process has been completed.

5) Once completed, open up the file and fill in any missing fields that you might be required to fill in, or have further information for (for example, termination details, date the employee changed their Superannuation company etc)

6) Save the CSV file and send this to your nominated clearing house to be processed and uploaded to the ATO.

User Security Settings

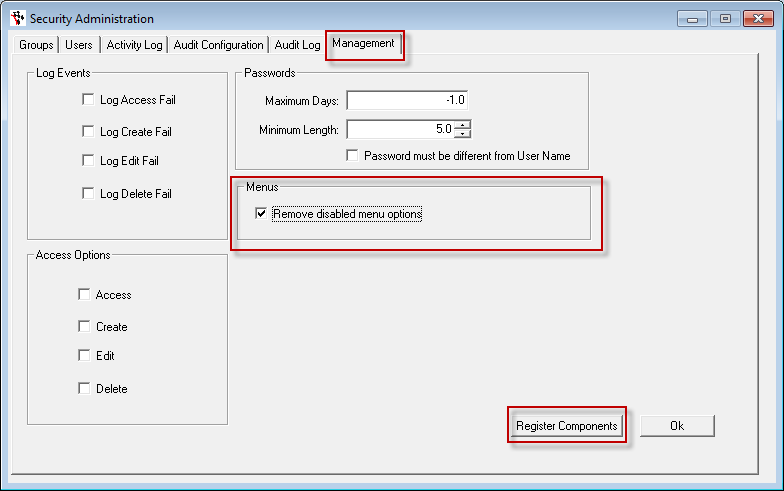

Go to Security - Security Maintenance - Management - UNTICK "Remove Disabled Menu Options" - Press "Register Components" - Reboot Payroll

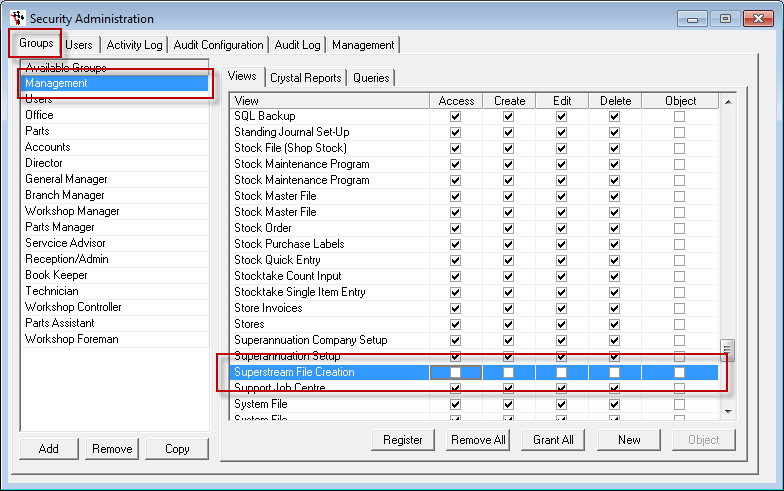

Go to groups, select the group that your User login belongs to. In the screenshot below I have chosen the group Management. (If you do not know which group your user login this is, go to the Users tab, select your user login and the group/s will appear on the right side of the two windows.)

Scroll down the list until you Superstreem File Creation. Note: the list is in Alphabetical order. Tick the boxes, then select the next line to save. Once you have completed this, close and reopen Autosoft.

- If the above is not in your list after this, and you have updated Autosoft to the latest version, then contact support by emailing support@autosoft.com.au

1 Comments