The purpose of this guide is to show you how to do a Opening Balance Transaction to enter the Opening/Carry over balances of Payroll Payments already processed in your previous payroll system without effecting your GLs.

NOTE: This is optional, another method is to enter all the payrolls processed thus far is to simply redo them via the normal payroll process and this will add the totals to the GLs.

Before you start this process;

1. Make sure you have followed the Payroll Setup Guides http://service.autosoft.com.au/entries/23105220-Payroll-Setup-Overview-Guide

2. Find out the totals of the PAYG summaries, payslips, and YTD payroll reports for each employee from your previous payroll system.

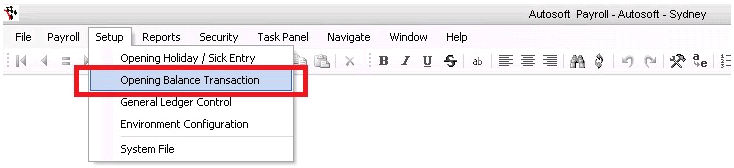

- Go to Payroll - Setup - Opening Balance Transaction

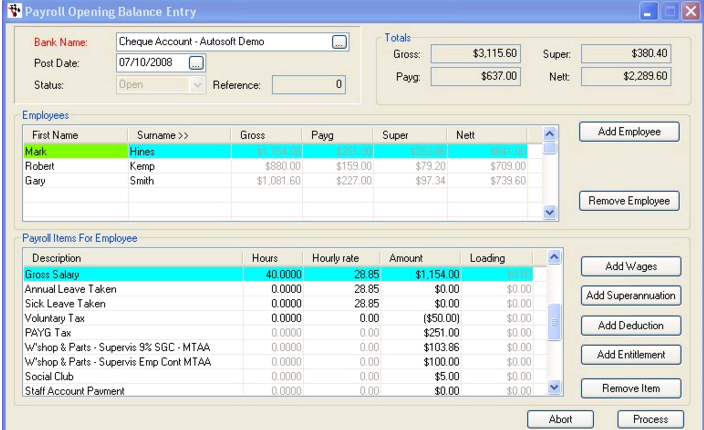

- Select the Bank name = select the bank that salaries and wages were paid from.

- Enter Post date = the date of the last payroll ran in the old system prior to going live in Autosoft payroll. (In our example 07/10/2008)

- Once you tab out of the post date field Autosoft will automatically populate the Employees and Payroll Items for Employee sections of the form using all the standard parameters that you setup for each employee. Select the Employee.

- Enter in the Balances for each employee of what has been paid to date. You will notice that the Payroll Items for Employees section of the window changes to reflect each employees standard wage attributes.

- Holiday/Sick Pay Taken Balances - If the amount you have entered in their Opening Holiday/Sick was including the pay they have already taken, you have to enter the amount they have taken in the Opening balance transaction http://service.autosoft.com.au/entries/23343415-How-to-Enter-the-Opening-Balances-of-Employees-From-Previous-System-Payroll- ALTERNATIVELY, if you only entered the amount they have left and do NOT enter any amounts taken in the Opening balance transaction.

NOTE: as these figures would be in you previous systems GL totals, these figures entered in this screen will not be posted to the General Ledger.

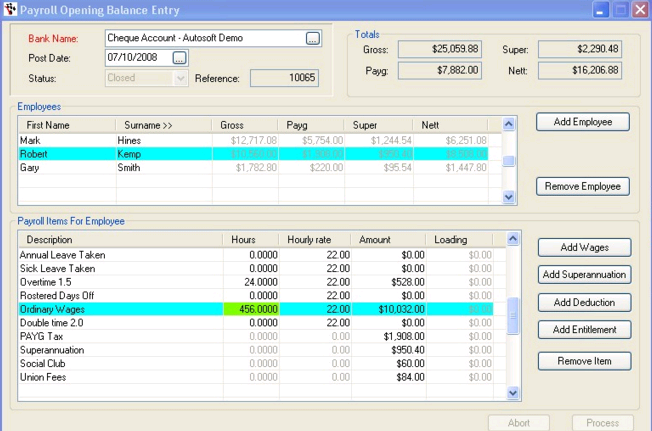

Example 1

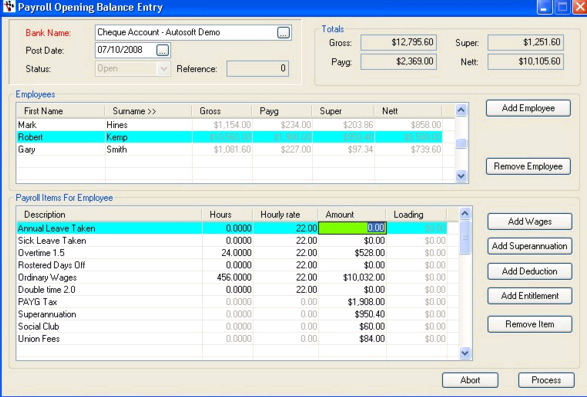

From the payroll report we ran from our old system Robert had YTD Gross Earnings of $10,032.00 from 456 hours, $528.00 overtime from 24hrs earnings, total PAYG deducted was $1,908.00, Super paid YTD was $950.40 and deductions of $60.00 for Social club and $84.00 for union fees, no sick or annual leave had been taken.

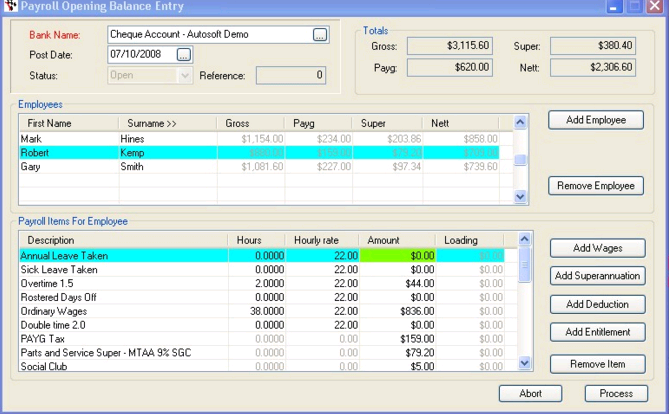

- By clicking on Robert's name in the Employees section we see his default standard wage structure populated in the Payroll Items for Employee section.

- In order to get the correct opening balance we must change the hours and amounts to reflect the opening position (see changes below).

- Click on each payroll description and tab across to the Hours, hourly rate and amount to get the correct totals for the opening balance.

Example 2

From the payroll report we ran from our old system Mark had YTD Gross Earnings of $10,032.00 from 456 hours, $528.00 overtime from 24hrs earnings, total PAYG deducted was $1,908.00, Super paid YTD was $950.40 and deductions of $60.00 for Social club and $84.00 for union fees, no sick or annual leave had been taken.

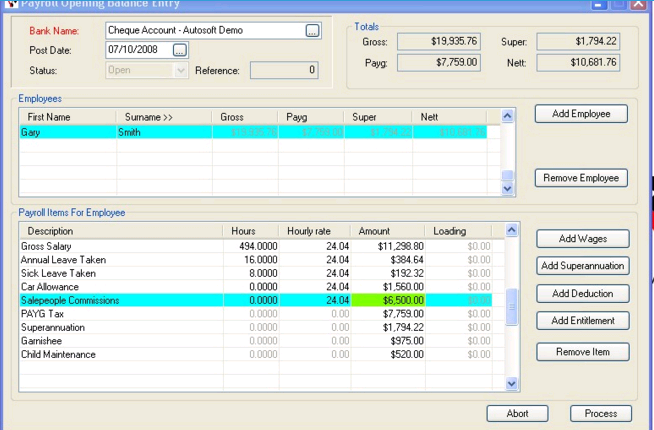

Example 3

Gary's balances were as follows: Gross Salary 494 hours, annual leave taken 16 hours, sick leave 8 hours, Car Allowance $1,560, Commissions $6500, PAYG $7759, Super SGC $1,794.22, Garnishee $975, Child maintenance $520..

0 Comments