The purpose of this guide is to explain how process an employees final pay out a employee and add annual leave owing to them.

This process is broken up into Parts- Working out what is owed to the Employee & Entering their Termination Date & Processing their Final Pay.

Note: It is easiest to follow this process once they have finished working their normal hours and you can process a payout separate to the rest of you Employees Payruns.

1. Finding out what is Owed to the Employee and Entering their Termination Date

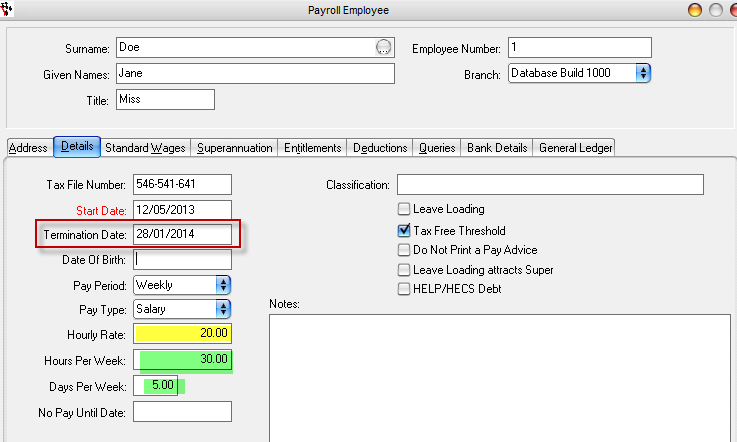

- Go to Payroll - Employee - Search and select the Employee

- In the Details Tab - Enter their Termination Date

- Also take note of;

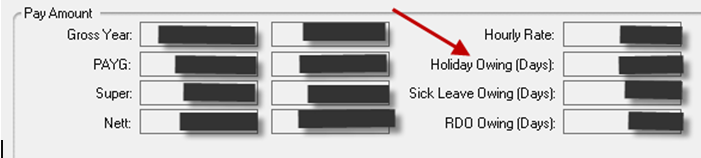

- Hourly Rate

- Hours Per Week / Days Per Week = Divide the Hours Per Week by the Days per week to work this out as a Daily amount.

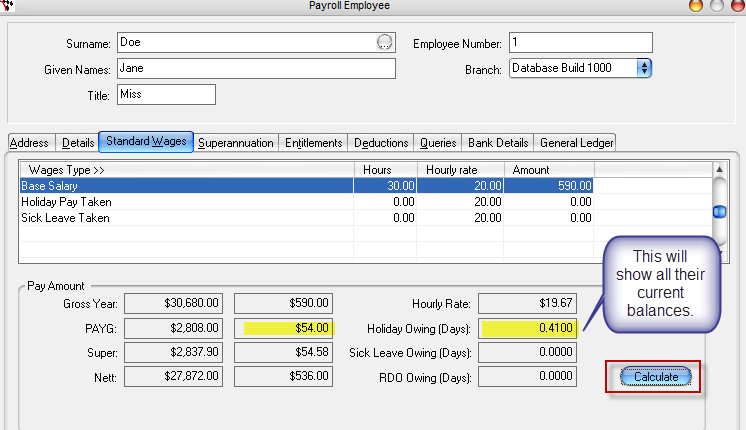

- Go to the Standard Wages Tab - Click 'Calculate'

- This will show you their totals up to date. Take note of their;

- PAYG Amount = this amount will have to be edited based on the ATO amounts and added/subtracted for the total amount you need to pay.

- Holidays Owing = This is the amount you will have to Pay them so will have to be times by their Salary Amount per day and any leave loading amounts also added.

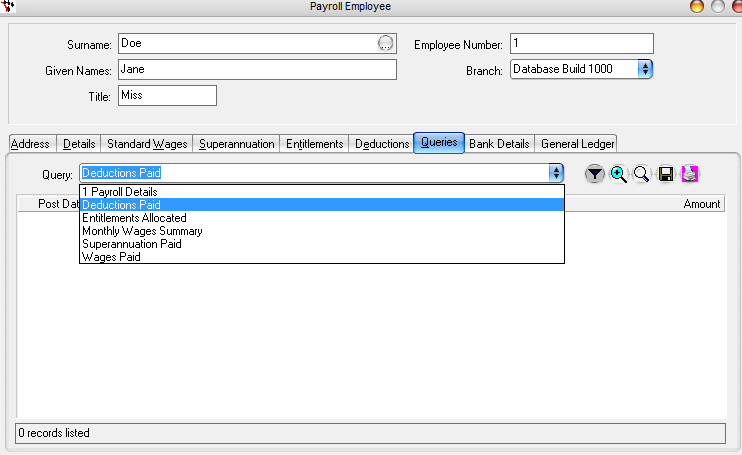

- If there are any additional amounts you need to have kept track of, you can go to the Queries Tab and run any further info queries as necessary

2. Calculating the Amounts to Enter and Processing the Payroll

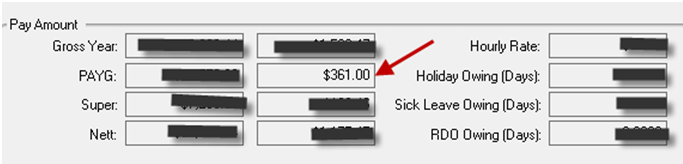

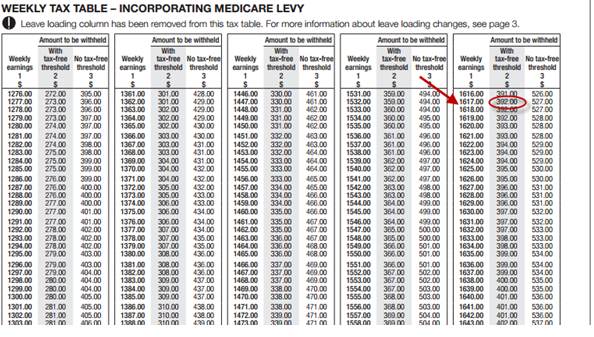

- Normal PAYG – S361

- Payment Amount ( this is the amount for the amount of annual leave days owing) divide by 52 $4141.36/52 = $79.64

- $79 cents ( take off cents)

- Add to normal wage $1538 + $79 = $1617.00

- Tax on $1617 ( Look at the tax tables through the ATO) = $392.00

- Subtract Normal PAYG $392.00 - $361 - $31.00

- Multiply by 52 $31.00 x 52 = $1612.00

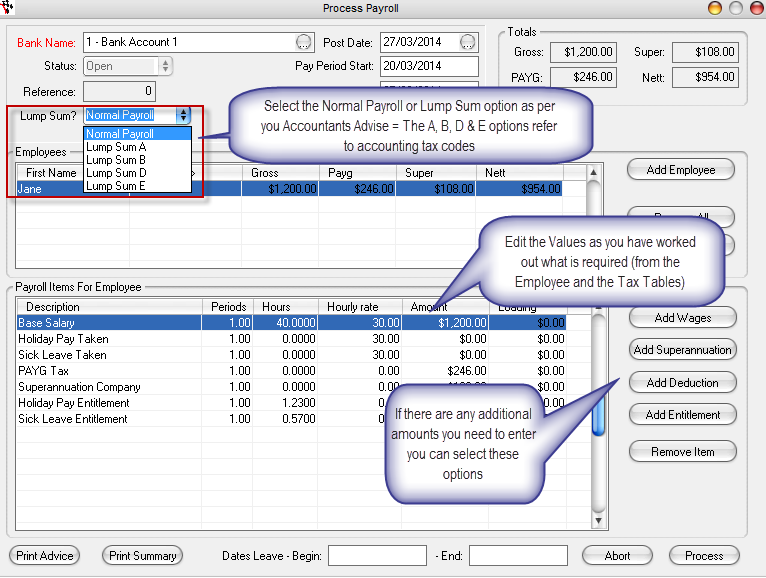

- Go to Payroll - Process Payroll - Enter the Payrun Details

- Check with you accountant as whether your calculations are correct and if a Lump Sum? has to be selected

- Remove all Employees except the Employee which is leaving.

- Enter in the Values as calculated

0 Comments