The purpose of this article is to show how to do a salary sacrifice and deduct it from the Gross or Nett wages of an employee.

There are 2 options for how you wish to setup the Employees Salary Sacrifice; Salary Sacrifice from Net Wage OR Salary Sacrifice from Gross Wage.

1. Salary Sacrifice from Nett Wage

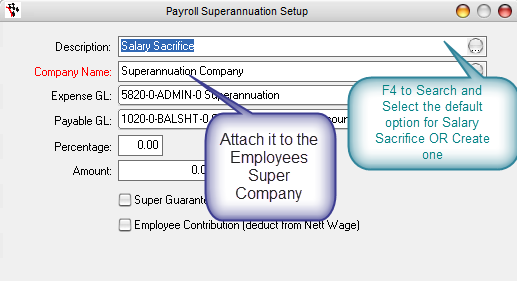

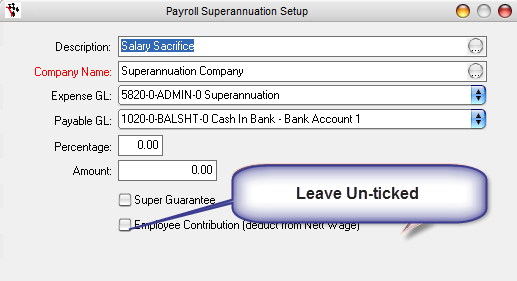

- Go to Payroll - Category Setup - Superannuation Setup

- Find and select or Enter in the Description for Salary Sacrifice

- Select the Company Name of the Employees super company

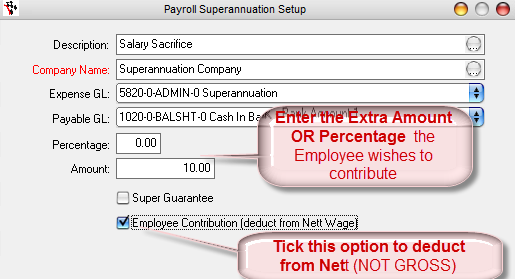

- Enter the Extra Amount OR Percentage the Employee wishes to contribute

- Tick the Box Employee Contribution (deduct from Nett Wage)

- F2 to Save

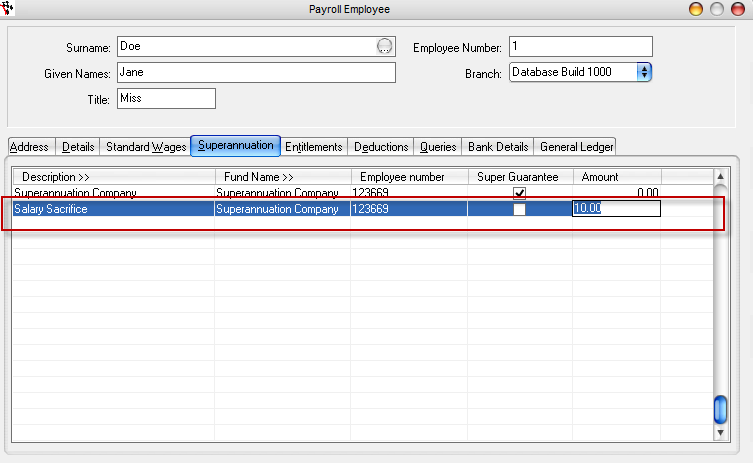

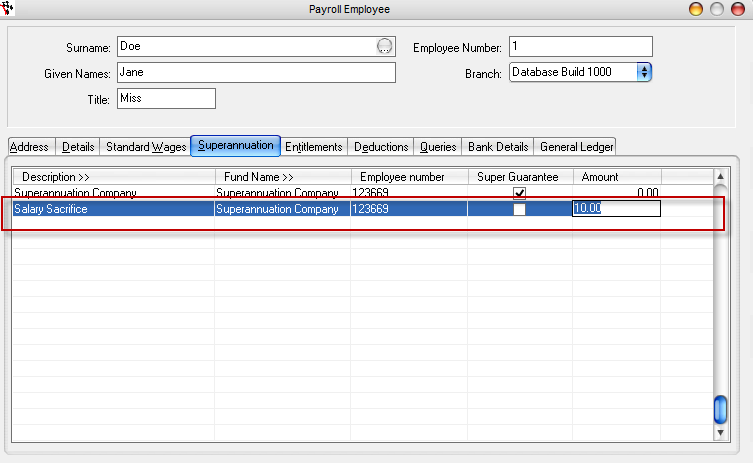

- Then Go to the Payroll - Employee - Search and Select your Employee

- Superannuation tab - Add the Extra Salary Sacrifice

- Enter the Employees Super Number and if it is a set dollar amount, enter the Amount (if it is a percentage, leave it at 0.00)

This will add the line to the Employees Payroll and will deduct the amount from the Nett Wage.

2. Salary Sacrifice from Gross Wage

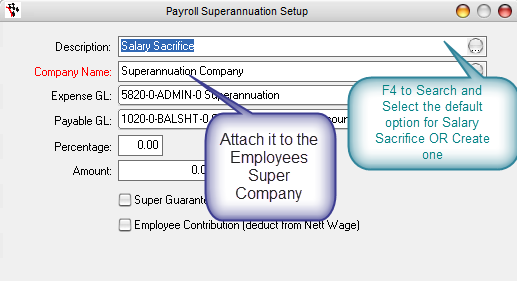

- Go to Payroll - Category Setup - Superannuation Setup

- Find and select or Enter in the Description for Salary Sacrifice

- Select the Company Name of the Employees super company

- Enter the Extra Amount OR Percentage the Employee wishes to contribute

- Do NOT Tick the Box Employee Contribution (deduct from Net Wage)

- F2 to Save

- Then Go to the Payroll - Employee - Search and Select your Employee

- Superannuation tab - Add the Extra Salary Sacrifice

- Enter the Employees Super Number and if it is a set dollar amount, enter the Amount (if it is a percentage, leave it at 0.00)

- If you also want to allow the original super calculation on their base wage before deduction, the amount entered must include the additional amount of the current super percentage.

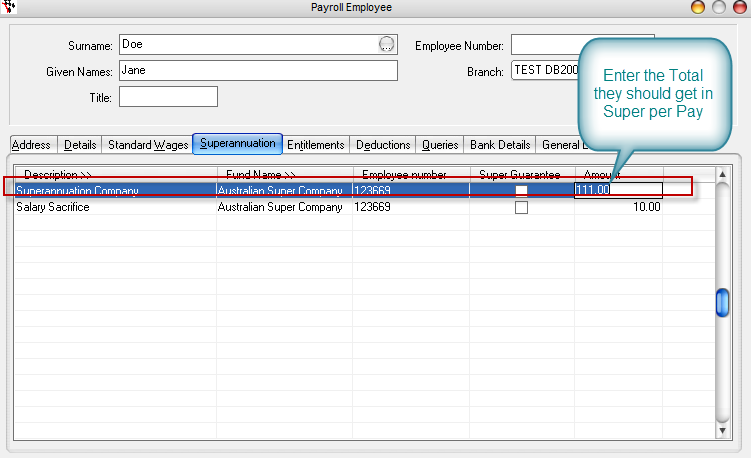

If you still need to be pay the Super Percentage for their Normal Pay amount;

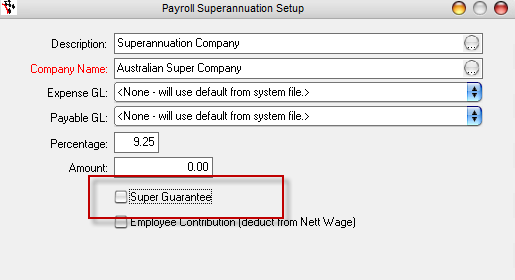

- Go to Payroll - Category Setup - Superannuation Setup

- Select the Super Company setup for their Normal Super

- Untick the Super Guarantee option

- F2 to Save

- Then on the Employee, you enter the amount in super based on their normal pay they should get

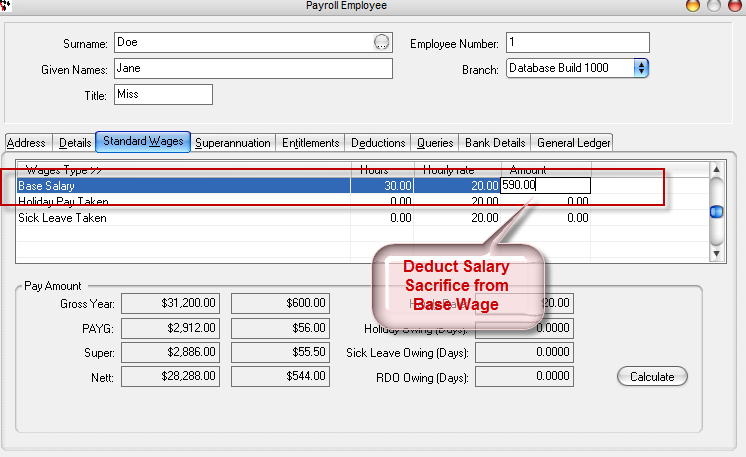

- Go to the Standard Wages Tab

- Reduce their Base Wage amount by the amount of salary sacrifice they wish to pay

- F2 to Save

THIS IS ADVISE ONLY we recommend you do a test run in the training database and check the GL Transactions individual report to make sure all the charges to GL accounts have processed as you require.

0 Comments