The purpose of this document is to learn how to do undeposited funds and how to process transactions through undeposited funds.

Undeposited funds works like a holding account; it keeps all your transactions that have gone through in the one place up until you see the funds in your bank account. The transactions will appear in your undeposited funds once you have completed a till reconciliation, these are your cash sales and some of your account customer debtor receipts, depending on what bank was selected when a debtor receipt was done. Once you have ticked all the transactions off through undeposited funds they will carry over to your Bank Reconciliation as credits, ready for you tick them off when you do your Bank Reconciliation. See below the process on how to process transactions through undeposited funds.

This is a 3 part process document which include banking your undeposited funds, saving the undeposited funds and viewing what was processed including those that was left as outstanding.

1. To Bank your Undeposited Funds

You should process your undeposited funds whenever you;

a) Go to the Bank to Deposit your CASH and CHEQUES

b) Check your On-line Banking/Bank Statement/EFT Settlement to see if the EFTpos and Credit transactions cleared to their nominated bank account.

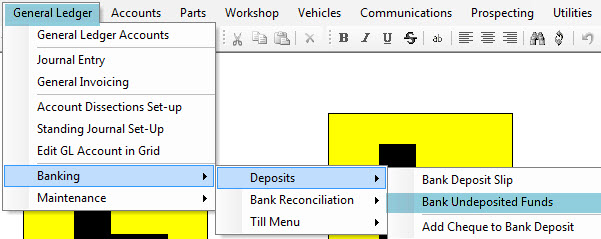

- Go to General Ledger – Banking – Deposits – Bank Undeposited Funds

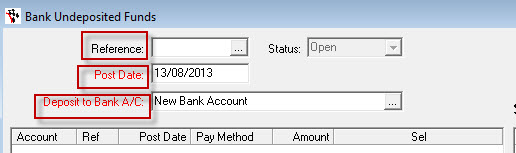

- Reference = the system will generate this for you

- Post Date = you must enter in that date the funds hit your bank account

- Deposit to Bank A/C = you need to select the bank that funds belong to

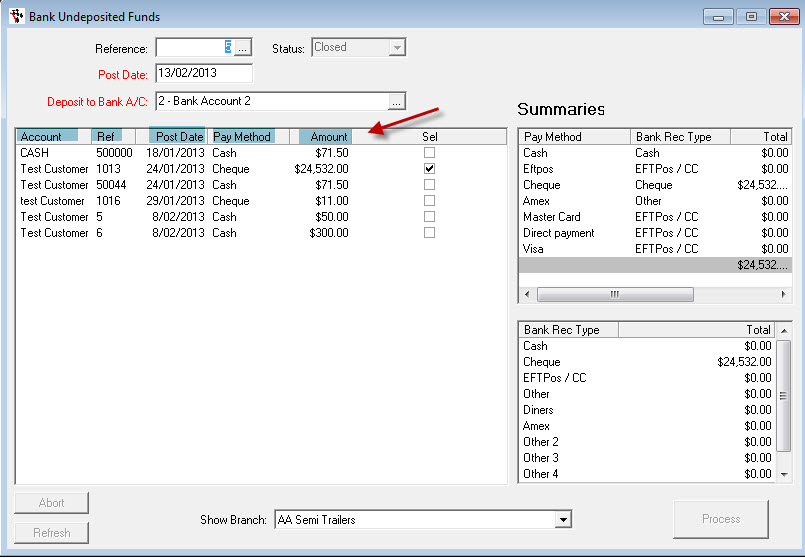

- You will now see transactions appear in front of you, you will see:

- Account

- Ref

- Date Posted

- Payment Method

- Amount

- Sel

- You can sort all of these column just by clicking on the headings

- Find the transactions that belong with what has hit your bank account

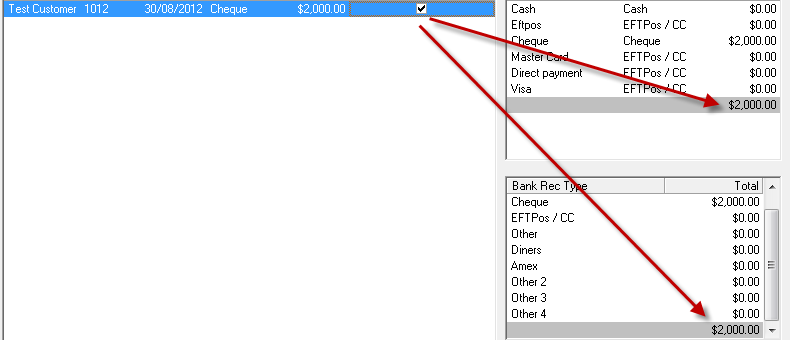

- Simply go through and tick the amounts and it will start to add up for you.

a) Go to the Bank to Deposit your CASH and CHEQUES - Sort by heading to tick all CASH and CHEQUES that you will bring the total to the amount you will be taking to the bank

b) Check your On-line Banking/Bank Statement/EFT Settlement to see if the EFTpos and Credit transactions cleared to their nominated bank account. = tick all the EFTpos, Credit transactions that total to the amount cleared for a particular date.

- You will see on the right hand side at the top summaries and this gives you a total of what you have ticked off

- At the bottom it shows you what it will look like in your Bank Reconciliation once you hit Process

- Once you are happy what you have ticked and it all matches you simply and easily click on Process

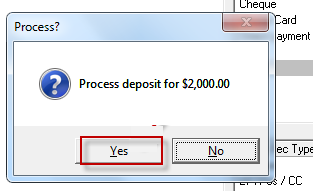

- You will get a message pop up in front of you “ Process deposits of $$$$” you now need to click Yes if its correct

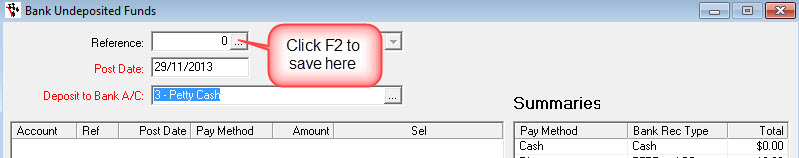

2. To Save the Undeposited Funds you are still working on

- Save your undeposited funds by clicking F2 on the Reference field

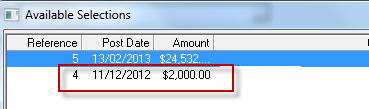

- To bring the saved undeposited funds click on the Reference Ellipsis and you will see it opened

- Click on the selections and it will appear in front of you the way you saved it.

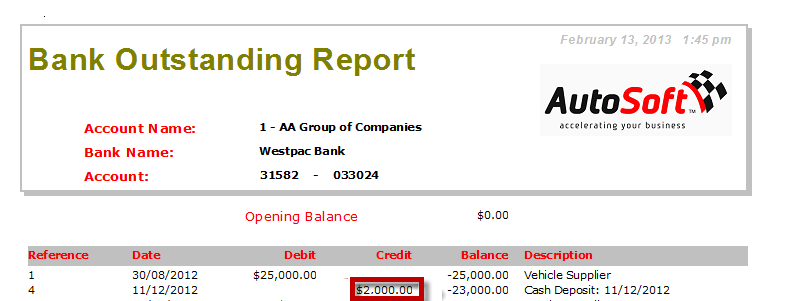

- Go to Report Console - Bank - Bank Reconciliation Outstanding

1 Comments