The purpose of this document is to show what is a General Ledger and how this is viewed and used in Autosoft.

General Ledger - is the means by which the measure of a business’s profitability is calculated.

On a basic level, the General Ledger contains default accounts programmed into the software that outline categories for which accounts can be listed as follows:

100-range accounts = Assets

200-range accounts = Liabilities

300-range accounts = Sales

400-range accounts = Cost of sales

500-range accounts = Expenses

This document is divided into 4 parts namely; viewing General Ledger Accounts, Control Accounts, General Ledger Account Maintenance and Reports.

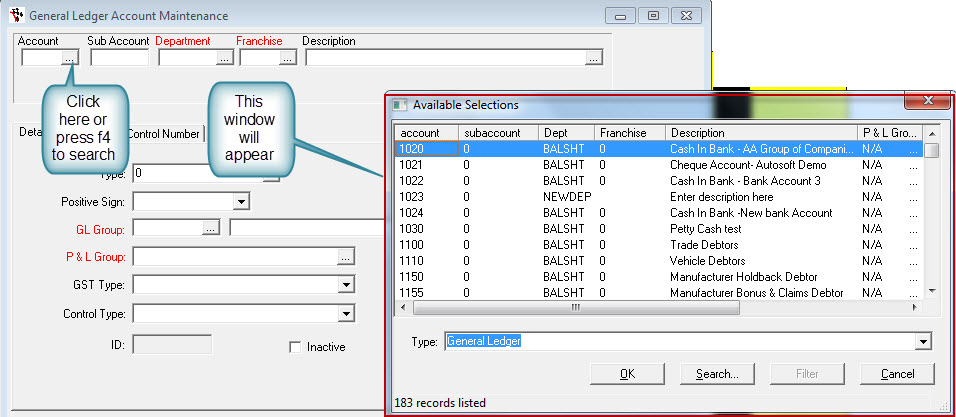

1. How to view the General ledger accounts within Autosoft

- Go to General Ledger - General Ledger Accounts

- Click on the Account field or press F4 to search for the General Ledger Account

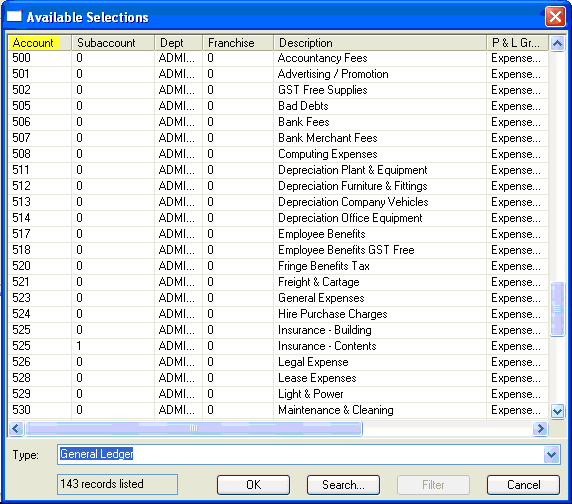

- You will get a list of accounts as below:

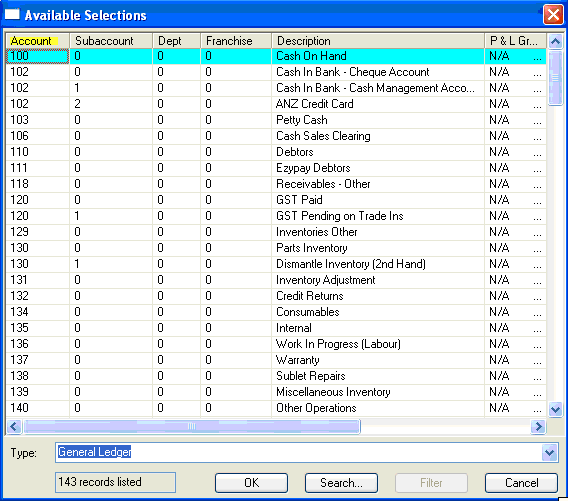

100-range accounts

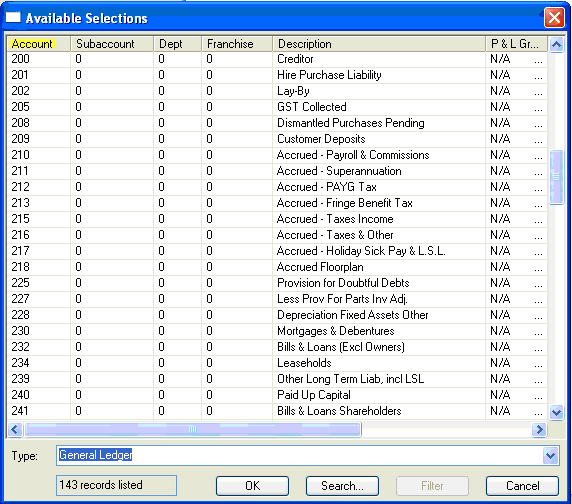

200-range accounts

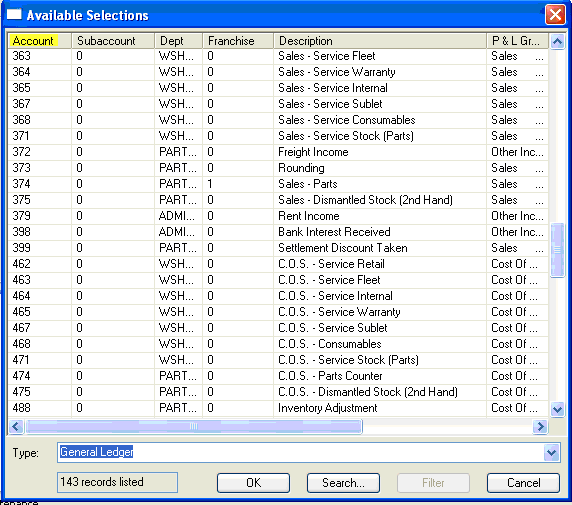

300 & 400 – range accounts

500-range accounts

Looking at the presentation of the accounts in this listing shows (from left to right):

- The Account number in the first column on the left.

- The Sub-Account number, of which there can be 99 assigned to a single account (for example to split up separate company vehicles under a single account)

- Department, eg Workshop, Accounts, Admin, Parts etc

- Franchise, another method of splitting up accounts (eg. Into franchise groups so Holden/Ford/Toyota etc)

- Description, for the designation of the account in the system

- P & L group, Profit and Loss group for seeing how much trading is done in that section – sales, cost of sales and expenses

Essentially the uniqueness of an account will be controlled by the first 4 fields left to right

- Account

- Subaccount

- Dept

- Franchise

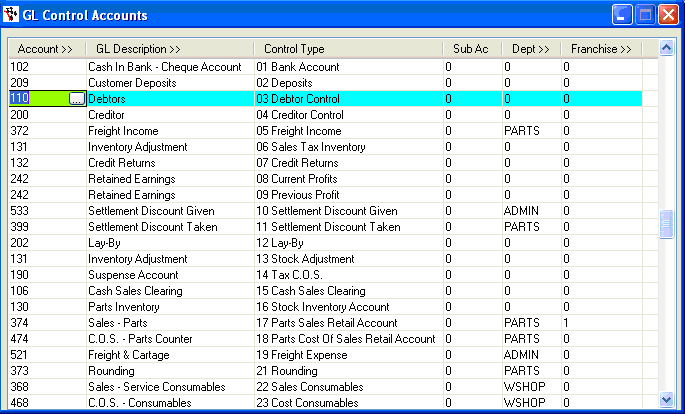

2. Control Account

-is an account pre-programmed into Autosoft which decides where money from a transaction is assigned.

-Control accounts are usually static and will not be modified or changed by the user.

-They are set up as a means of deciding where aspects of an invoice like GST are directed so that this doesn't need to be specified on each invoice created.

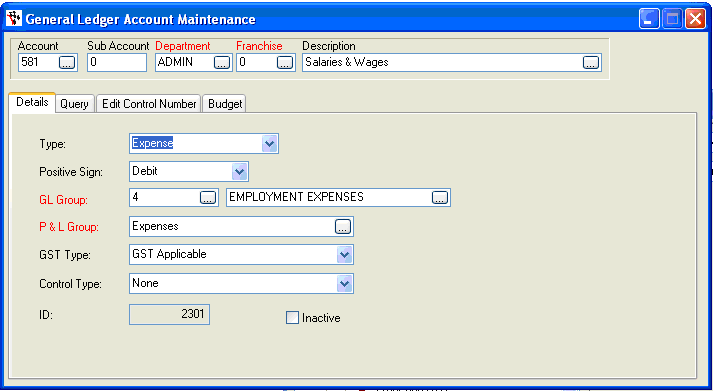

3. General Ledger Account Maintenance

Type - determines which part of the balance sheet the account will be represented on.

P & L Group - will determine Profit and loss group. The Balance will show the statement of value (ie what the business is worth) and the P & L will refer to the sales that are being done and what it has cost

Note: A company can have a low value, but do a lot of trading, and vice versa a company can have a high value but do little trading. Profit Loss income should in theory lead to greater business value – unless some other drain on the funds pool is being experienced (eg business owner draining the funds-pool)

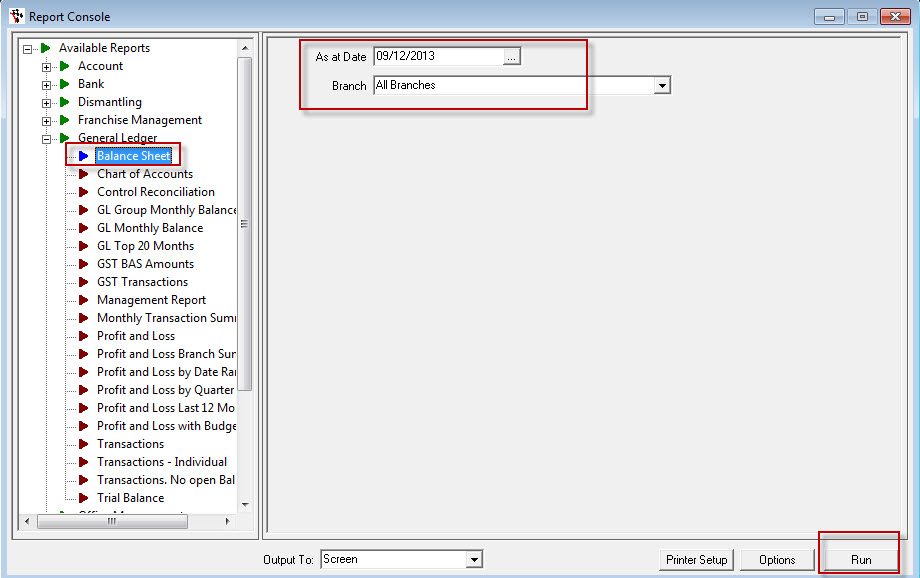

4. Reports

Two reports in Autosoft that deal with tradings and values

- Balance Sheet

- Profit and Loss

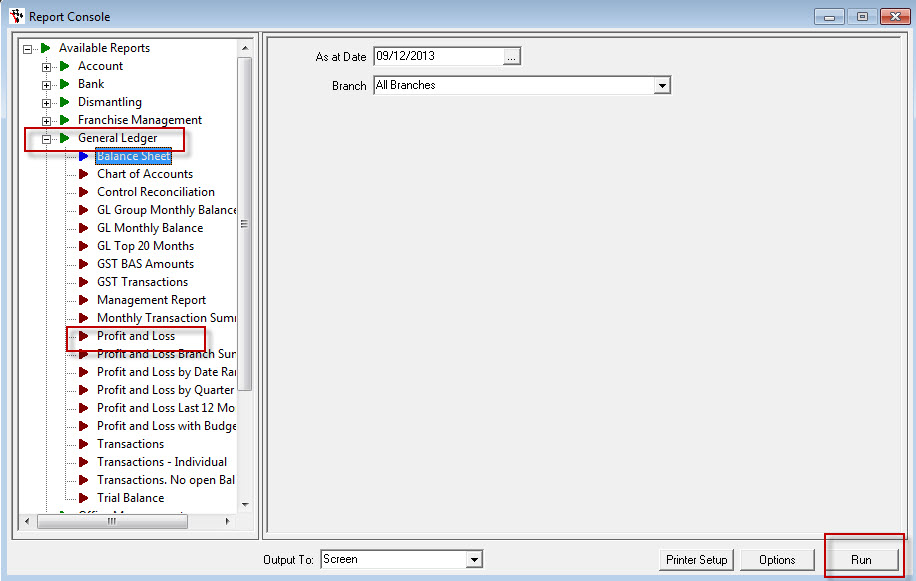

To run a Balance Sheet Report:

- Go to Reports - Report Console - General Ledger - Balance Sheet

- Specify Date and Branch

- Click Run

To run Profit and Loss Report

- Go to Go to Reports - Report Console - General Ledger -Pofit and Loss

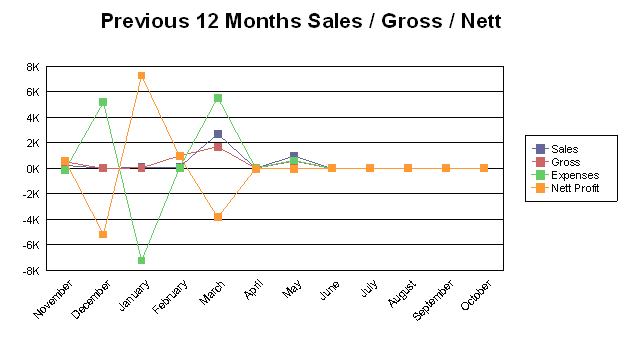

Profit and Loss will produce a graph for the period selected weighing up Expenses vs Sales

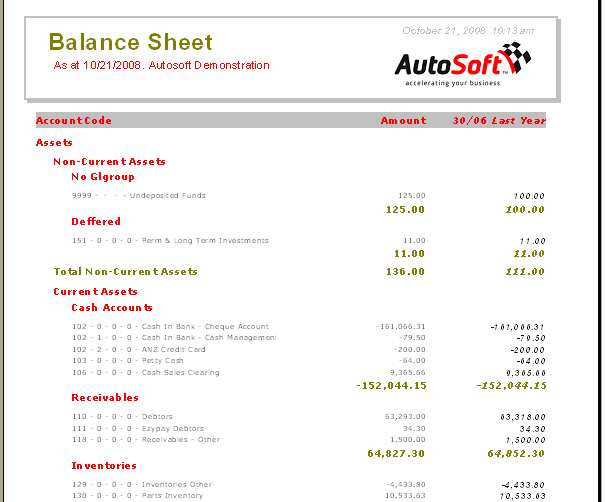

Balance summary will give an indication of the Assets vs Liabilities

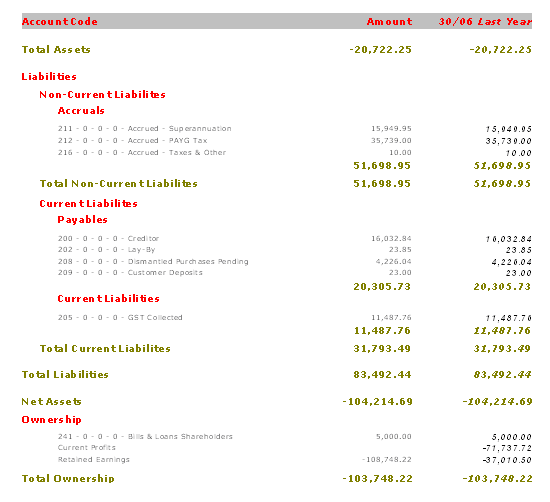

And at the end of the report will provide the net earnings of the business in the ownership section: This example shows a total Assets value of -$20722.25 (top of figure below) and a total Liabilities of $80492.44 meaning the net assets are Negative-$104214.69. Essentially the business would be losing money in this example and would be insolvent as the Total ownership is in negative.

Total sales – Cost of Sales = Gross Profit

Gross Profit = Profit made from Trading

Gross Profit – Expenses = Operating Profit/Loss (or Net profit/loss)

Appropriations can be included in the mix after Operating or Net profit/loss is calculated and is usually referred to as a separate item (eg Net Profit after appropriation)

Appropriations can include things such as share dividends or company taxes – essentially items that are not part of the profitability of the business – profit not generated by the business itself.

0 Comments