The purpose of this guide is to explain how to create an internal Account which you can then charge internal Parts and Labour to.

This process has been broken up into 3 Parts - Checking/Creating the Workshop Sale Type for Internal, Creating the Internal Account and Invoicing.

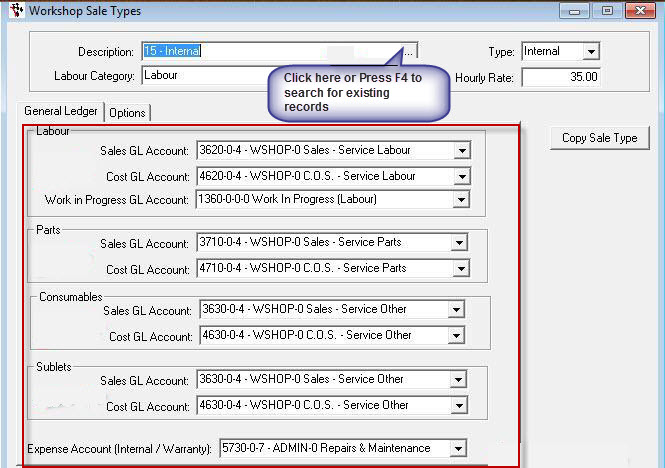

Part 1 - Checking/Creating the Workshop Sale Type for Internal

To Set up your internal workshop sales types, Go to;

- Workshop – Workshop Sales type

- F4 to search for an existing “Internal” option - there should be a preset default one you can use - if not create one by Entering the details as follows

- Check the GL codes that are selected and change if required.

- Last GL code for “Expenses Account” needs to be 5730 – 7 as repairs/maintenance or this can be changed to what you require.

- You can move the expense account around by doing journal entries.

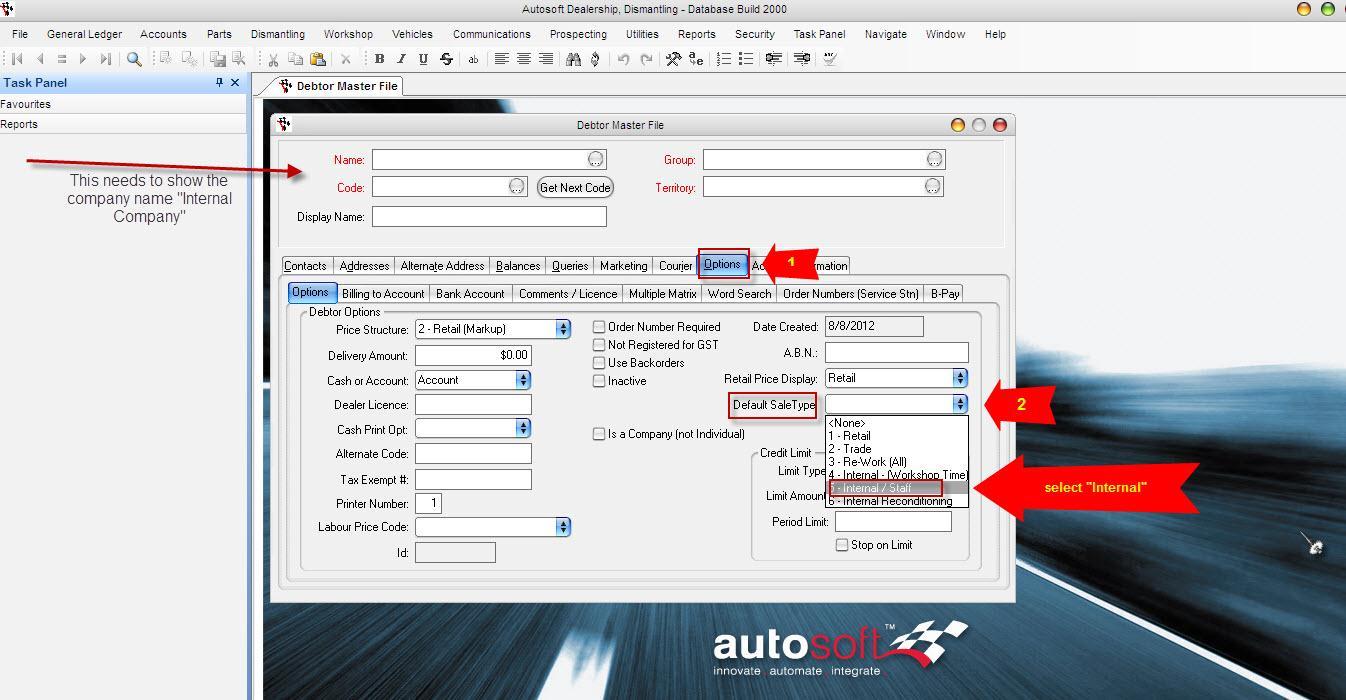

Part 2 - Creating the Internal Account

- Go to Accounts - Debtors - Debtor Master File

- Create a debtor for you internal company. “Internal Company” or the name of the business

- Click Options tab, click dropdown on the Default Sales Type and select “Internal”.

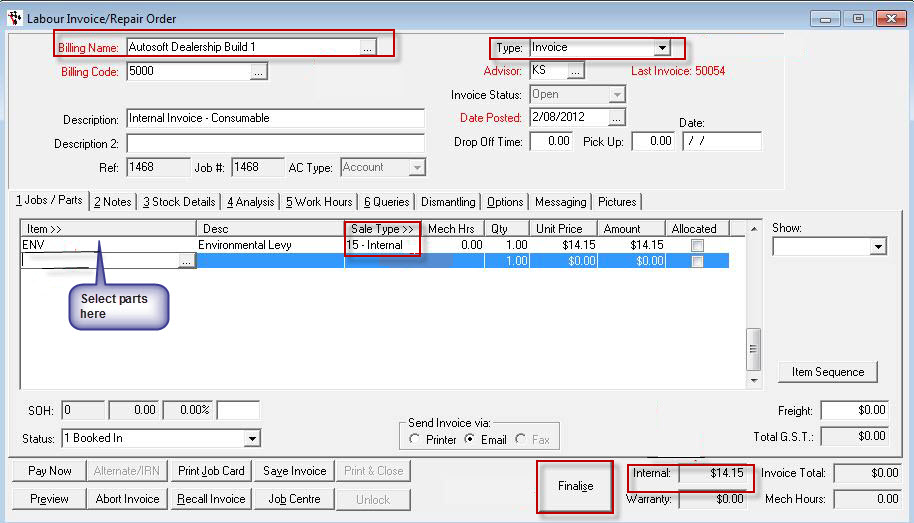

Part 3 - Invoicing

Invoice it out through the Labour Invoice under workshop. Go to;

- Workshop - Invoice/Repair Order - Labour Invoice/Repair Order

- Select Billing name as the internal company that you set up

- Add the Parts and/or Labour you wish to charge (making sure the “SaleType” is set to Internal)

- Finalise and this will record the invoice charge on the internal GL account and against the Internal Debtor Account for tracking/claiming.

5 Comments