The purpose of this guide is to show you how you can exclude GST on the sale of some items purchased by individuals (eg pensioners) or organizations (eg churches) may be entered as GST Free depending on their entitlements. This exemption will usually be represented by a Tax Exempt number which can be entered into Autosoft, and an option checked to not apply GST to any invoice created in Parts/Workshop.

This process has been broken up into 2 Parts- Setting Up the Customer as Exempt from GST and Processing the Customer Invoice.

Part 1 - Setting Up the Customer as Exempt from GST

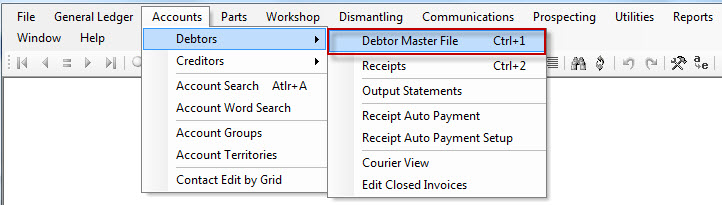

- Go to Accounts - Debtors - Debtor Master File - Search and Select the Customer (or Create them as normal)

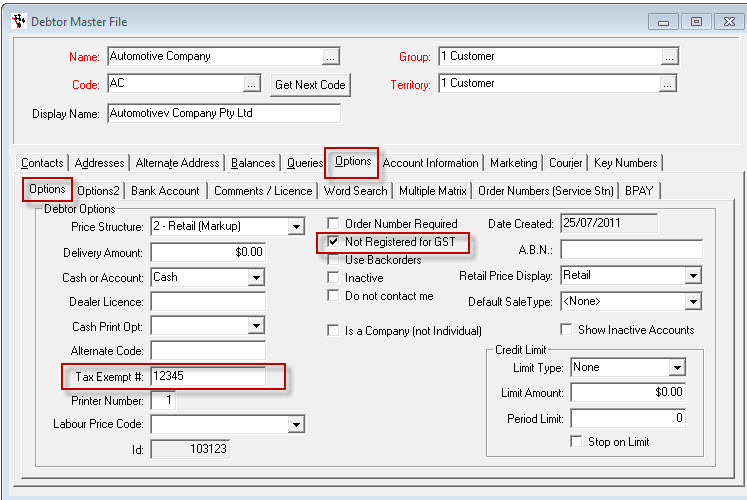

- Go to the Options tab (highlighted yellow)

- Enter in the Tax Exempt number (#) or reference

- Tick to Select the ‘Not registered for GST’

Part 2 - Processing the Customer Invoice

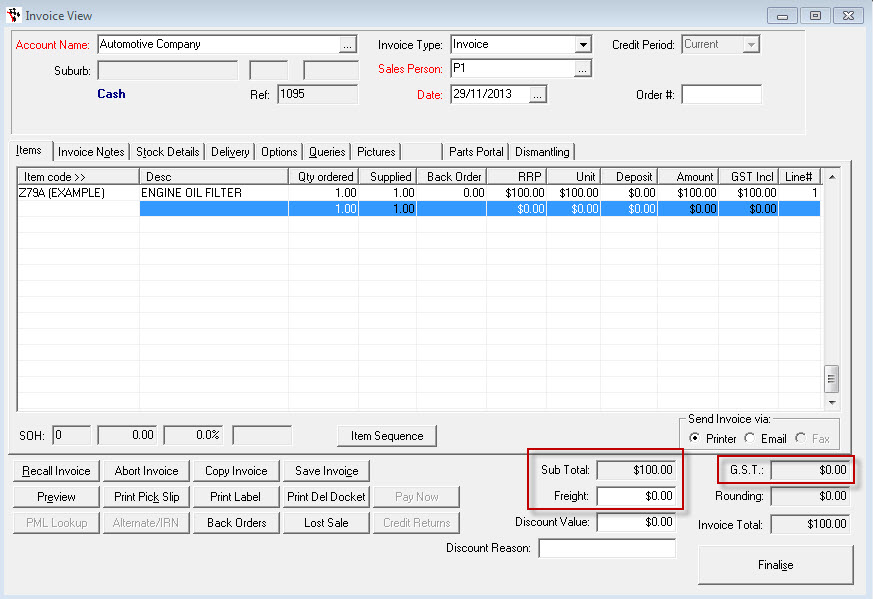

Process any type of Customer Invoice for this Customer as applicable and Check the values for the GST are zero and Preview if required to see how the Invoice will appear.

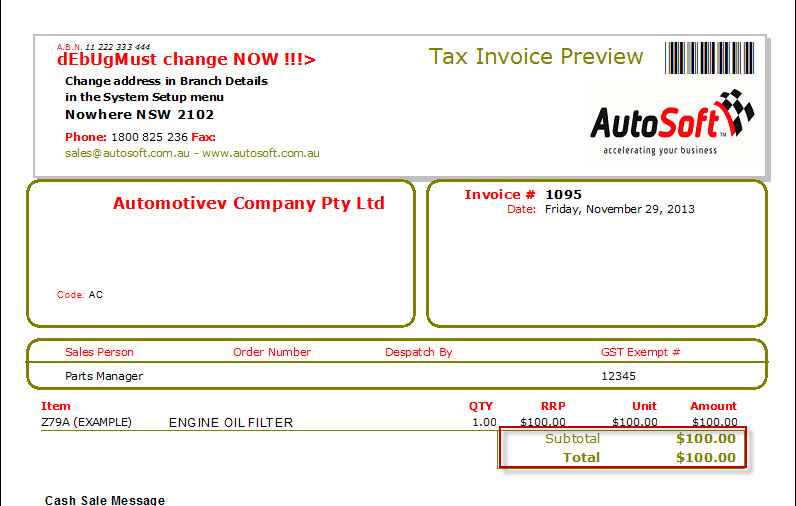

The invoice preview will show a subtotal and Total, and there should be no GST applied to the item if done correctly.

2 Comments