The purpose of this guide is to explain how to to offset Program credits received AFTER the vehicle has been sold.

NOTE: This procedure may not be suitable to you as it is a way to reduce both the Floorplan and the Cost of the Vehicle. If this is not what you are trying to achieve please contact us for a consultation.

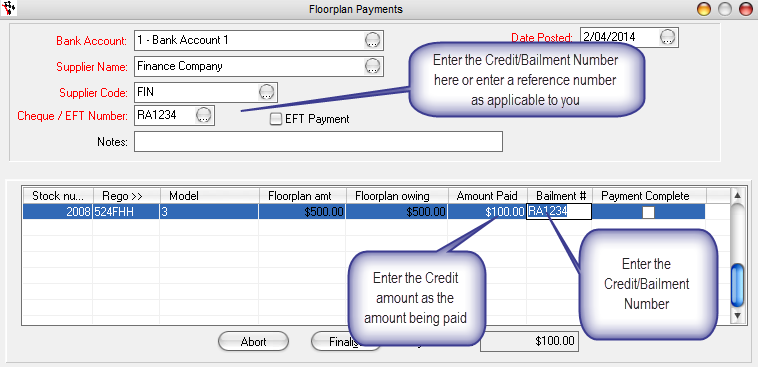

1. Credit the Floorplan Amount via Floorpan Payment

- Go to Vehicles - Pay Vehicle Floor Plan.

- Enter the Credit as a Floorplan Payment – GST inclusive (enter the Bailment/Credit Number in the CHQ/EFT and the Bailment Number areas). This will create an entry in the Bank Rec of the selected Bank Account.

e.g I received a Credit for $100 off my floorplan amount

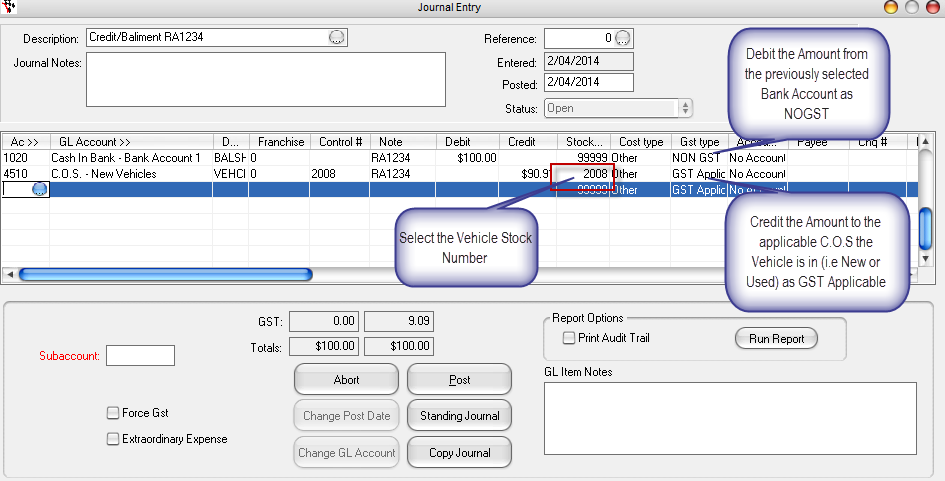

2. Journal to Reconcile the Bank Account and Reduce the Cost to the Vehicle

- Go to General Ledger - Journal Entry

- Enter the Credit/Balment Number in the Description (or any other description which will help you keep track of it)

- the amount GST incl from the Bank Account– 1010 (tick non GST) to the C.O.S Vehicle Stock GL Account– 4410 – GST Excl amount (tick GST applicable and Select the Vehicle Stock Number

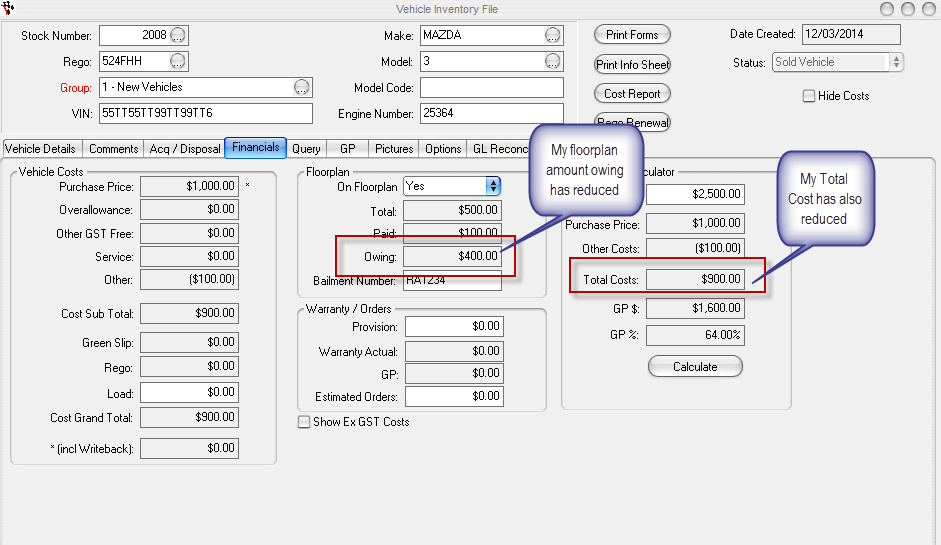

This will reduce the vehicle cost - As you can see on your reports and in the Vehicle Inventory File

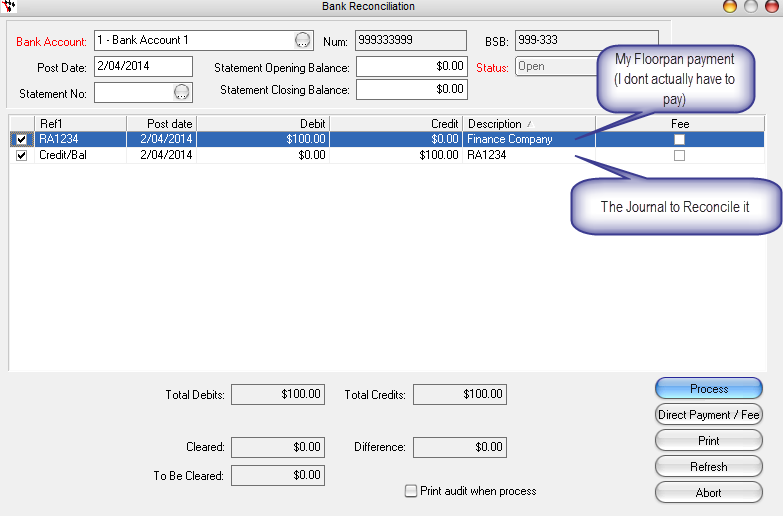

AND Create a credit so I can reconcile it in the Bank Rec.

0 Comments