The purpose of this guide is to show you how to cross check the totals you get on various reports needed before lodging you BAS.

These are Basic Cross Checks that a bookkeeper should perform at the end of each month whether they are using Autosoft or any Accounting package.

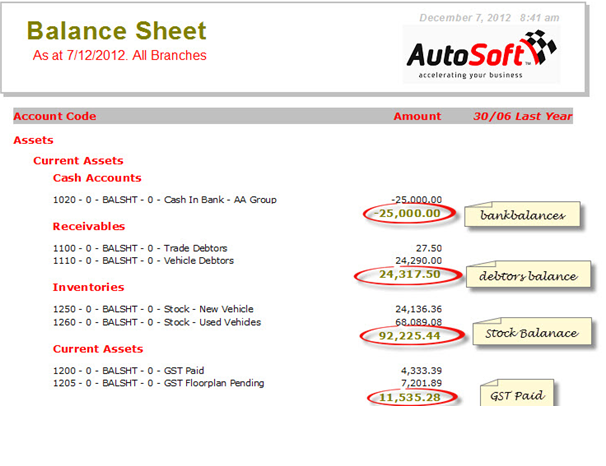

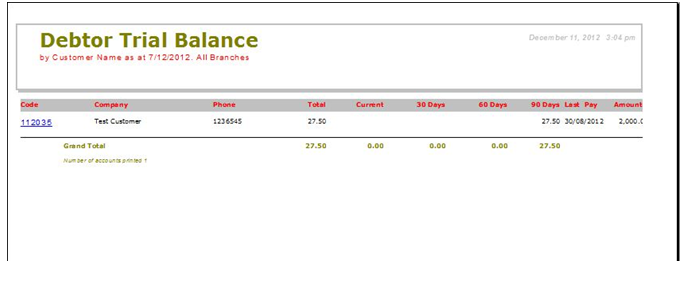

Balance Sheet (refer to image below)

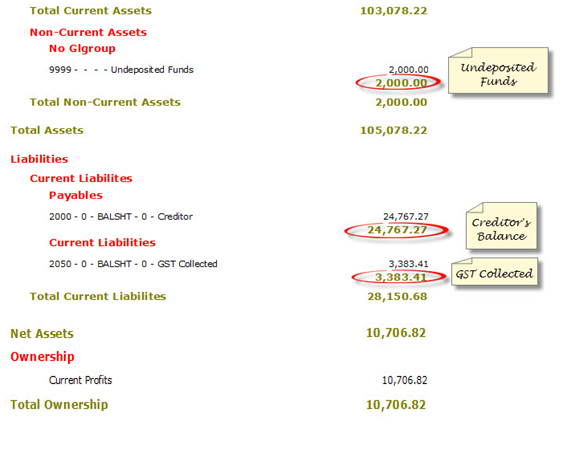

Undeposited Funds

Bank Balances

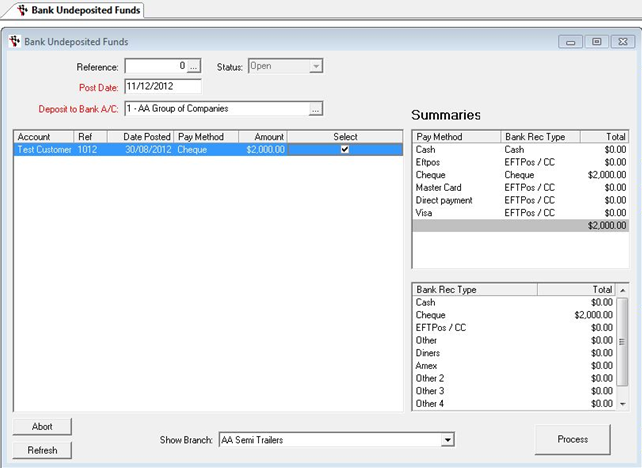

Debtors Balance

Stock Balance

Creditors Balance

GST Paid

GST Collected

PAYG Withheld

Super Accrued

Reports to Cross Check

Simply add up the total of the undeposited funds screen

Bank Rec Outstanding Report

Debtors Trial Balance under accounts - Debtor/Creditor Trial Balance

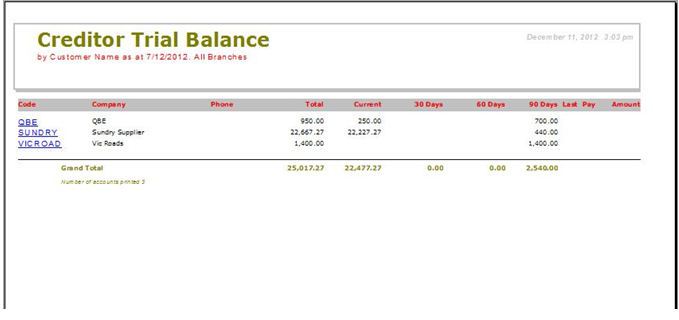

Creditor trial Balance-under accounts –Debtor/Creditor Trial Balance

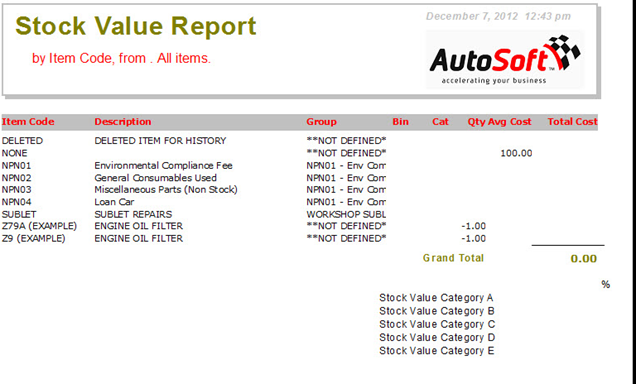

Stock Value Report - under stock - stock value

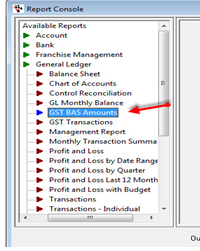

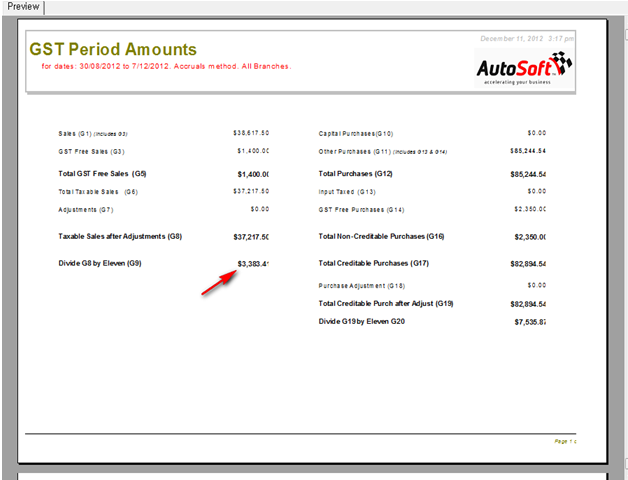

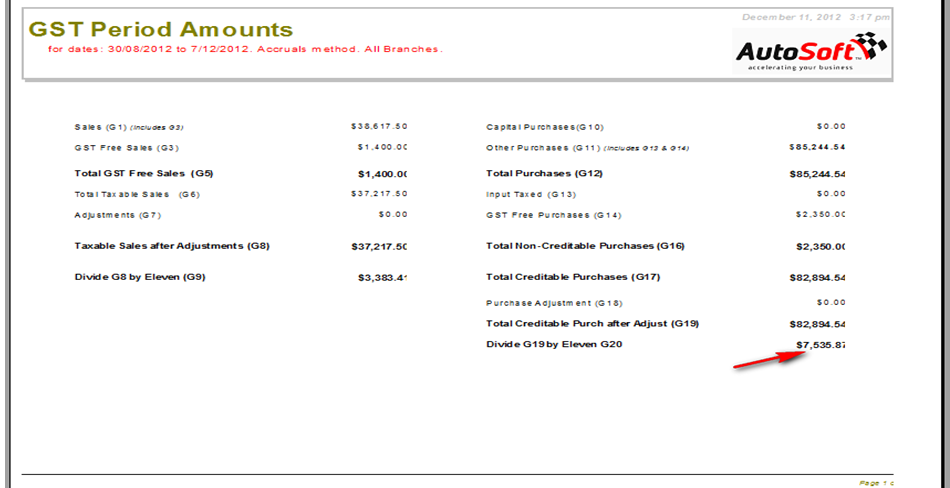

GST BAS Amounts Report (GST Collected Total) - Under general ledger (refer to images below)

GST BAS Amounts Report (GST Paid Collected Total) - Under general ledger (refer to images below)

Payroll Totals Report - Since data last Paid (PAYG) - Payroll - Transactions by employee

Payroll Totals Report – Since date last Paid (Super) - Payroll - Transition by employee or the one called payroll superannuation.

You should run the Balance sheet then each of the reports above for the same date, immediately after printing the balance sheet. It is best that these reports are run whilst no one else is in the system.

0 Comments