The purpose of this document is to show how to process your PAYG payment through Autosoft and also what reports you can run to help you complete your PAYG form.

This is a 2 Part Process which include running your report and putting the transaction through your Autosoft system.

1. Run Your Report

Note: Report you can run that will help you with your form is as follows – You can do this through Autosoft Payroll Software ( you can only run this report if you have purchased payroll as a separate module)

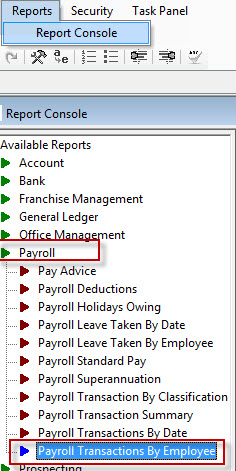

- Go to Reports – Report Console – Payroll – Payroll Transaction by Employee

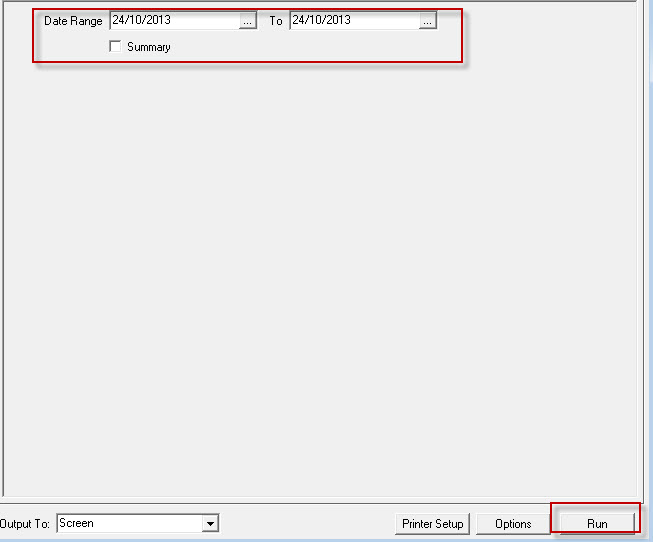

- Enter in your Date Range and click Run

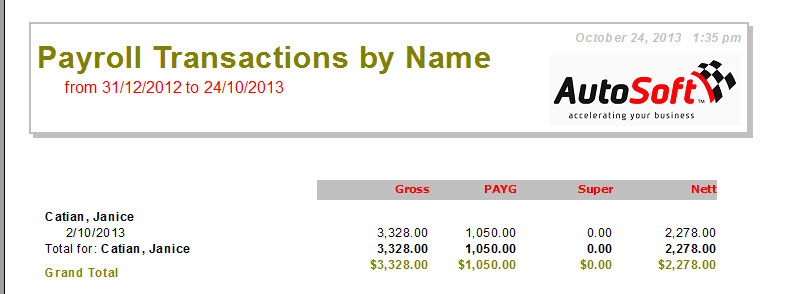

- Print off this report and fill out your form from the tax office

2. Put the transaction through your Autosoft system

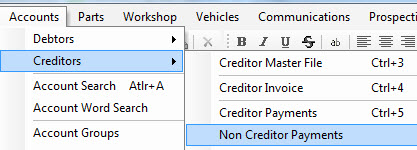

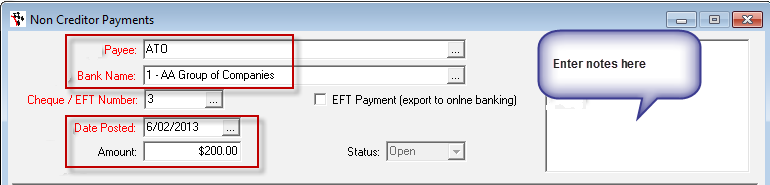

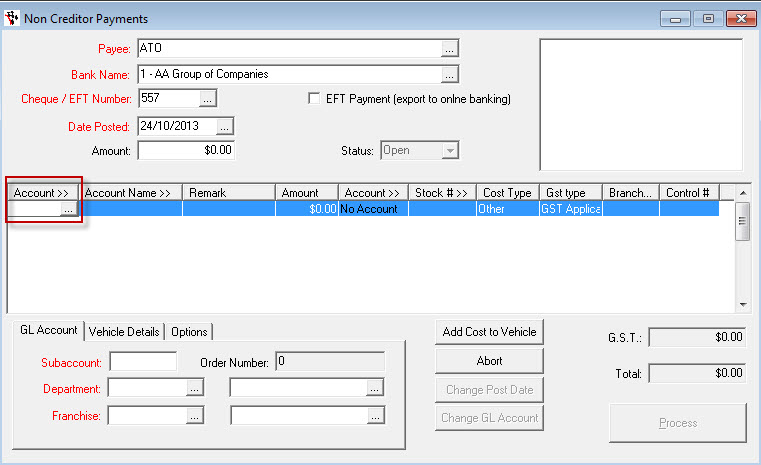

- When doing a Non Creditor Payment to put the transaction through, simply go to Accounts – Creditors – Non Creditor Payment

- For a sample payee; ATO, select the Bank Name this payment is coming out of

- Enter in your Date Posted (date that are paying this at)

- Enter in the Amount

- Enter some Notes if need be

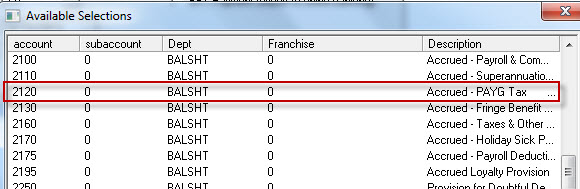

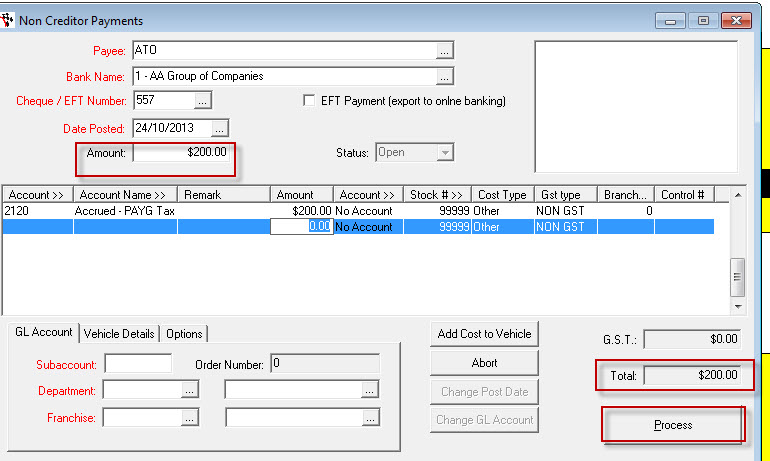

- You now need to enter in the Account Field a general ledger code – example 2120 ( Accrued – P.A.Y.G Tax) however you can speak to your accountant to get advice on what the best general ledger code to use

- Once the amounts match you can click on Process

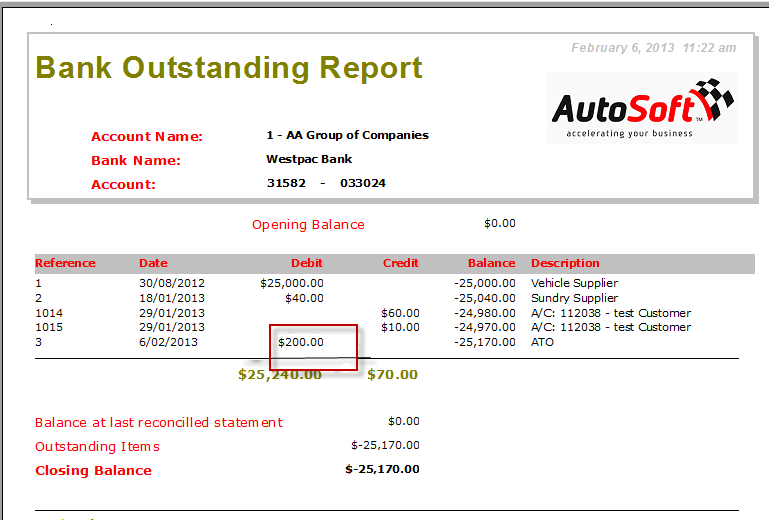

- Once you process you will see the transaction in your bank reconciliation

0 Comments