The Purpose of this document is to outline a system for ordering and Invoicing GST Free Parts.

This process has been broken Up into 3 Parts - Setting Up the Supplier as GST Free, Processing the Order/Creditor Invoice and Checking the GL Transaction.

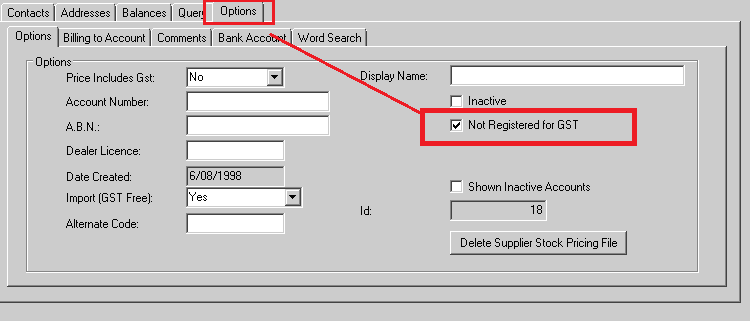

Part 1 -Setting Up the Supplier as GST Free

- Go to Accounts - Creditor - Creditor Master File - Search and Select the Supplier

- Go to the Options Tab - Select the Options as applicable i.e. Tick to select the 'Not Registered for GST' option

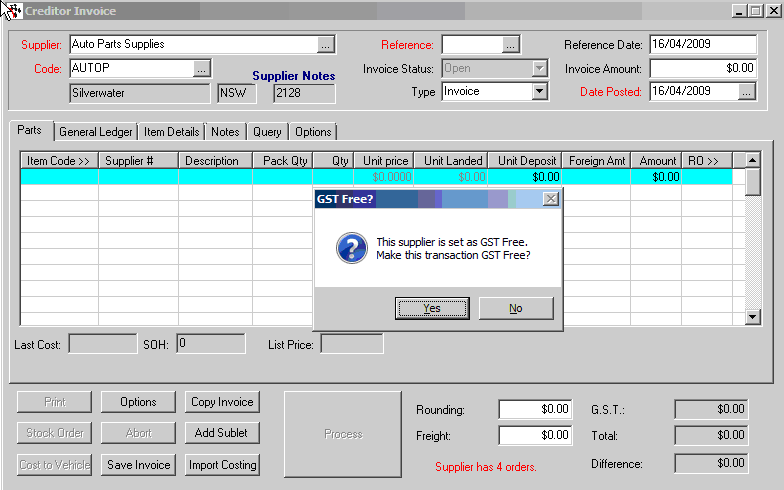

Part 2 - Processing the Order/Invoice

Create your Order (http://service.autosoft.com.au/entries/21825929-How-To-Order-Stock-and-Link-it-to-a-Job-RO-Saved-Invoice) &/or your Creditor Invoice as Normal (http://service.autosoft.com.au/entries/21431875-How-to-Process-a-Creditor-Supplier-Invoice-with-or-without-a-Stock-Order) then;

- When you first select your Supplier - following message should appear, select Yes:

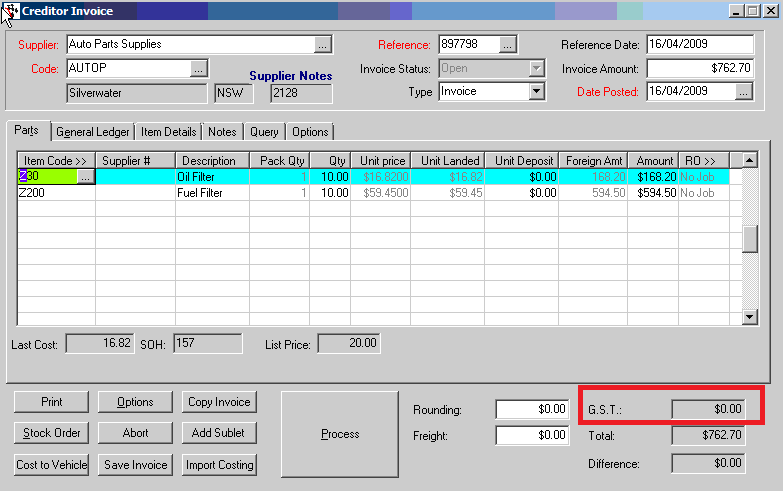

- Add your stock order, note that GST has not calculated:

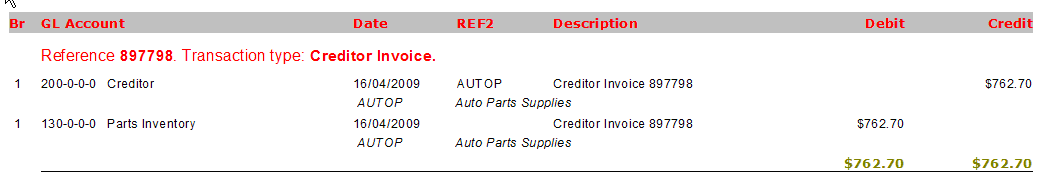

Part 3- Checking the GL Transaction

If we run a GL Transaction Report – Individual for the Creditors Invoice Reference number we can see that the Parts Inventory has been debited for the invoice amount and the creditors balance has been credited for the invoice amount, and no GST has been collected.

When selling parts that were bought on this stock order, GST will calculate on the sale as per normal. If you need to on-sell the parts with no GST - see this guide on how to Sell Parts to a Customer without GST http://service.autosoft.com.au/entries/22333504-How-to-Invoice-a-Customer-Exempt-from-GST

OR For a full guide on International Supplier Invoicing - http://service.autosoft.com.au/entries/21508725-International-Import-Creditor-Invoicing-Freight-Options-GST-on-Freight-and-Creditor-General-Ledger-P

0 Comments